UK SMEs are taking on extra risk by not purchasing employers’ liability insurance as its penetration rate falls again, with nearly a quarter of those believing the risk to their staff is minimal, according to GlobalData, a leading data and analytics company. This leaves them open to the risk of large payouts in the event of an injury to one of their employees, and also leaves some SMEs breaking the law.

GlobalData’s 2021 UK SME Insurance Survey found the penetration rate for employers’ liability insurance among SMEs in the UK was just 62.5% in 2021. SMEs are exempt from legal requirements as long as they have one employee who is a director and owns 50% or more of the capital, or if they only employ family members or staff outside the UK (though these SMEs represent a small proportion).

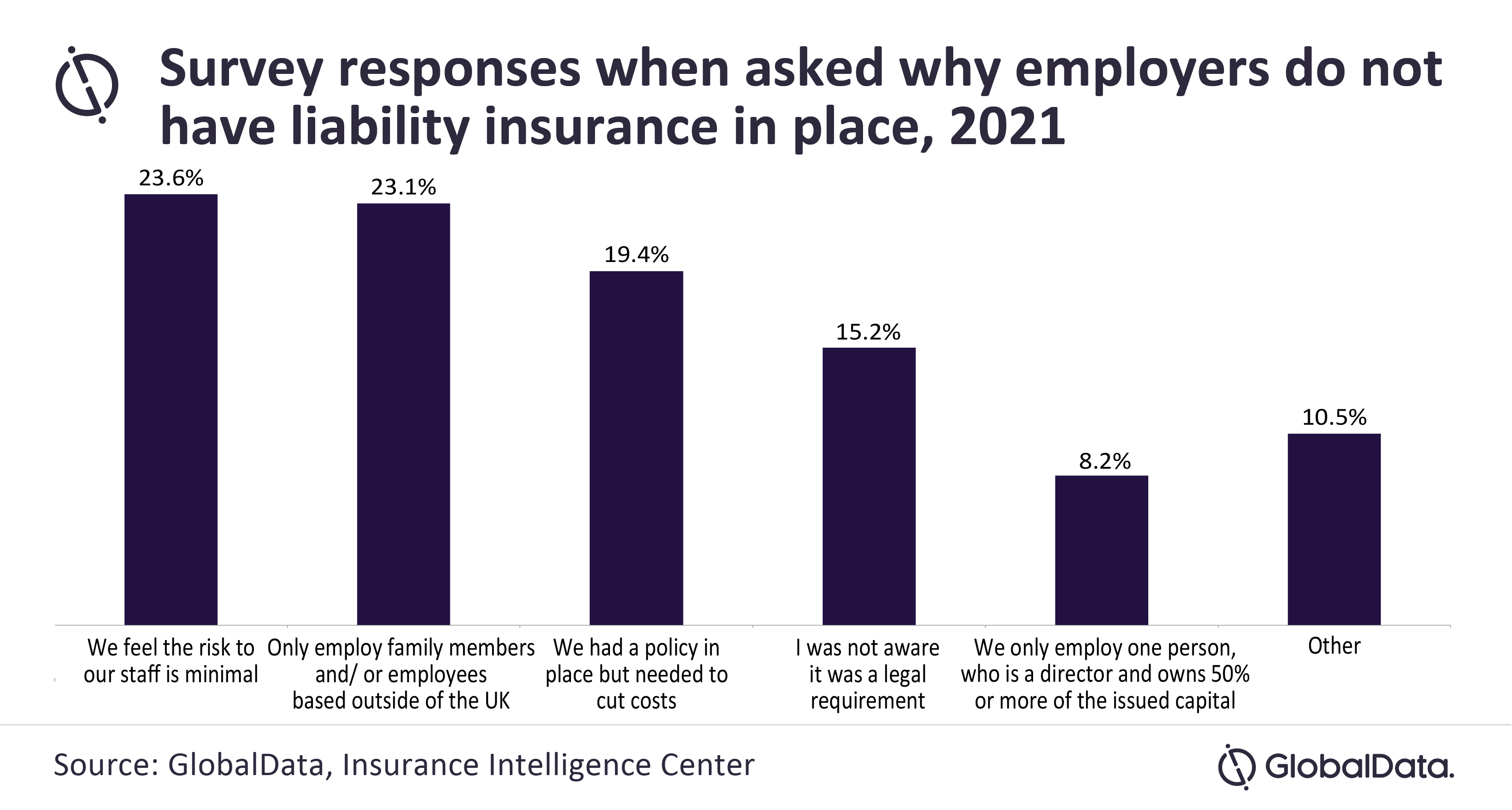

Ben Carey-Evans, Insurance Analyst at GlobalData, comments: “This is low for a product which is required by law. Follow-up questions identified that the key reasons as to why SMEs who need to have such insurance did not have it in place were that SMEs were willing to take the risk as a need to cut costs, and being unaware it was legally required.”

Carey-Evans continues: “The relatively low penetration rate for employers’ liability is a long-term trend identified by GlobalData’s annual UK SME Insurance Survey. Previous editions of the survey found that only 65.4% of SMEs held it in 2020, 65.5% in 2019, and 63.4% in 2018. While this is a long-term trend, it is something insurers should look to change.”

GlobalData’s survey found that 15% of respondents who did not have this cover in place stated it was because they did not know it was a legal requirement, representing a target audience that insurers should try to reach through education.

Carey-Evans adds: “The 2021 penetration rate of 62.5% is the lowest in the last four years. This indicates that some SMEs could have decided against this type of cover, as budgets have been squeezed by COVID-19, or maybe did not take up on renewals, which fell during periods of lockdown.

“Yet, COVID-19 could help insurers in the longer term. If more SMEs turn to brokers for advice to make sure that their business insurance is fit for purpose, or even simply conduct more research before purchasing insurance for the same reason, the proportion of SMEs who are unaware that employers’ liability insurance is a legal requirement will come down.”