PROF. MANOJ KUMAR PANDEY – ASSOCIATE PROFESSOR OF INSURANCE, MARKETING – BIMTECH

Siraj Dudekula – Business Solutions Specialist – Coforge

Anvesha Upadhyay – PGDM IBM BIMTECH

Abstract

Generative AI technologies are rapidly reshaping the landscape of the insurance industry by revolutionizing traditional practices in risk assessment, underwriting processes, and claims management. This white paper provides a comprehensive exploration of the significant applications of Generative AI in insurance, supported by detailed case studies from leading insurance companies. By leveraging advanced machine learning algorithms, insurers can optimize decision-making processes, enhance customer experience, and mitigate risks more effectively than ever before.

INTRODUCTION

The insurance industry, traditionally known for its reliance on actuarial tables and statistical models, is undergoing a profound transformation with the advent of Generative Artificial Intelligence (AI). Generative AI, a subset of AI that enables machines to generate new content, images, or data that mimic human-like creativity, is proving to be a game-changer in how insurers assess risks, underwrite policies, process claims, and interact with customers.

This white paper delves into the myriad ways in which Generative AI is revolutionizing the insurance landscape, offering unparalleled opportunities for insurers and the technology providers to enhance operational efficiency, improve risk management strategies, and deliver personalized customer experiences.

As we know that the Generative AI has been a branch of Artificial Intelligence and the Machine Learning, it is necessary for us to refer and understand on the fundamental aspects of what these technologies mean.

Introduction to Machine Learning, Artificial Intelligence, and Generative AI

Artificial Intelligence (AI)

Artificial Intelligence (AI) refers to the simulation of human intelligence in machines that are programmed to think and learn like humans. AI encompasses a wide range of technologies and applications, from simple rule-based systems to complex neural networks. The goal of AI is to create systems that can perform tasks that typically require human intelligence, such as understanding natural language, recognizing patterns, solving problems, and making decisions. Much in 2010s to present, the advent of deep learning and neural networks, lead to significant advancements in AI capabilities, including image and speech recognition, Natural Language Processing (NLP), and autonomous systems like robots and driverless cars.

Machine Learning (ML)

Machine Learning (ML) is a subset of AI that focuses on the development of algorithms and statistical models that enable computers to learn from and make predictions or decisions based on data. In the recent years, we have seen developments in resurgence of neural networks, especially deep learning, driven by advancements in hardware (GPUs) and massive datasets, leading to breakthroughs in computer vision, natural language processing, and reinforcement learning.

Generative AI

Generative AI creates new content, like images, text, and music, by learning patterns from existing data. Models like Generative Adversarial Networks (GANs) and Variational Autoencoders (VAEs) generate data like their training data. Early generative models, such as Hidden Markov Models (HMMs) and Gaussian Mixture Models (GMMs), were used for tasks like speech synthesis and image generation. Introduction of GANs by Ian Goodfellow and colleagues in 2014 marked a significant milestone. GANs consist of two neural networks (a generator and a discriminator) that compete against each other, leading to the creation of highly realistic synthetic data. From then, the development of more sophisticated generative models, such as VAEs and Transformer-based models (e.g., GPT-3; Generative Pre-Trained Transformers), has expanded the capabilities of generative AI. These models can generate high-quality text, images, music, and even video content, opening new possibilities in creative industries and beyond.

In summary, AI, ML, and Generative AI have evolved significantly over the past few decades, driven by advancements in algorithms, computational power, and the availability of large datasets. These technologies continue to transform various industries, offering new opportunities and challenges as they advance.

The Role of Generative AI in insurance

Generative AI, including machine learning, NLP, and computer vision, allows insurers to automate and optimize processes, analyze data in real-time, identify patterns, and predict risks accurately, thereby reducing claims payouts and enhancing profitability through AI-driven predictive analytics.

Advantages of Generative AI in Risk Management

Advantages of Generative AI in Risk Management

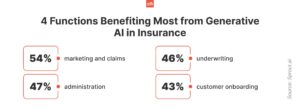

There are certain functions benefiting most from the Generative AI in Insurance.

Automation of Underwriting Processes

Generative AI offers several advantages when applied to underwriting processes in risk management:

1. Speed and Efficiency: in underwriting process, reducing the time required to assess risk and make coverage decisions.

2. Accuracy and Consistency: Risk assessments are objective and based on data-driven insights rather than subjective judgments.

3. Risk Prediction: Insurers can use AI’s insights to adjust premiums, offer appropriate coverage, and mitigate potential losses proactively.

4. Customization: AI can recommend personalized coverage options that align with customer preferences and risk tolerance.

Improving Claims Processing Efficiency

Generative AI enhances claims processing efficiency through various capabilities:

1. Automated Document Analysis: Accelerates claims processing times by reducing manual data entry and paperwork.

2. Fraud Detection: Helps insurers identify and investigate potential fraud cases early, minimizing financial losses and protecting against fraudulent activities.

3. Fast-track Processing: Streamlined approach improves turnaround times of the claims.

4. Decision Support: AI provides data-driven insights and recommendations for claim settlements

Enhancing Customer Service and Personalization

Generative AI contributes to superior customer service and personalization in several ways:

1. 24/7 Support

2. Personalized Recommendations

3. Natural Language Processing (NLP)

4. Predictive Analytics

Generative AI offers significant advantages in risk management by automating underwriting processes, improving claims processing efficiency, and enhancing customer service through personalized interactions and predictive analytics. Insurers adopting AI technologies stand to benefit from increased operational efficiency, reduced costs, and improved customer satisfaction in a competitive insurance landscape.

Applications of Generative AI in Insurance

Applications of Generative AI in Insurance

Generative AI is revolutionizing various aspects of the insurance industry, enhancing efficiency, accuracy, and customer satisfaction across key areas such as risk management, underwriting, and claims processing. Here are several ways in which Generative AI is being applied:

Risk Management

1. Predictive Modeling: Generative AI analyzes historical data to predict risks, aiding insurers in adjusting premiums, enhancing pricing models, and proactive risk management.

2. Fraud Detection: Generative AI flags potential fraud early, saving costs and enhancing trust with real-time anomaly detection.

3. Natural Disaster Prediction: Generative AI forecasts natural disasters using data, aiding insurers in resource preparation, policy adjustment, and risk management.

Underwriting Automation

1. Automated Underwriting: Generative AI automates underwriting, swiftly analyzing data to generate accurate risk profiles, reducing errors.

2. Personalized Policies: AI customizes insurance policies by analyzing customer data, enhancing satisfaction and retention through tailored coverage.

Claims Processing

1. Claims Assessment: AI algorithms streamline claims processing by analyzing data, reducing costs and errors, and enhancing customer satisfaction through automation.

2. Customer Service: Generative AI empowers chatbots to handle queries and claims 24/7, enhancing customer experience and freeing human agents for complex tasks.

Customer Engagement

1. Behavioral Analysis: Generative AI helps insurers tailor marketing and communications by analyzing customer behavior data, enabling targeted campaigns, personalized interactions, and improved customer retention strategies.

2. Predictive Customer Insights: AI algorithms can predict customer behavior and preferences, enabling insurers to offer timely, relevant products and services, thereby optimizing customer lifetime value and anticipating needs.

Risk Assessment and Pricing

1. Dynamic Pricing: AI algorithms analyze data to adjust premiums based on changing risk factors, ensuring fair pricing and competitive advantage through dynamic pricing models and real-time predictive analytics.

2. Portfolio Management: Generative AI optimizes insurance portfolios by identifying high-risk areas, suggesting mitigation strategies, and recommending adjustments to enhance profitability and stability through AI-driven tools and algorithms.

Regulatory Compliance

1. Automated Compliance: AI tools help insurers stay compliant by monitoring regulatory changes, analyzing policies, automating audits, flagging risks, and recommending corrective actions to ensure adherence.

2. Data Privacy: AI algorithms enhance data security and privacy by identifying vulnerabilities, ensuring compliance with regulations, encrypting information, and monitoring data access to safeguard customer information.

Generative AI is revolutionizing insurance by boosting efficiency, enhancing risk management, and personalizing customer experiences, making the industry more agile and customer centric. We shall further refer to various successful implementations of Generative AI in the Insurance industry in the following Cases.

Lemonade Insurance: Innovating Underwriting with MAYA

Lemonade Insurance, a digital-first company, uses Generative AI to transform underwriting in homeowners and renters insurance, enhancing transparency, efficiency, risk assessment accuracy, and profitability.

Implementation of Generative AI:

Lemonade utilizes a proprietary AI-powered platform known as Maya. Maya is designed to handle various aspects of the insurance process, including underwriting. Here’s how Lemonade implemented Generative AI to revolutionize underwriting:

1. Data Integration and Analysis: Lemonade integrates vast amounts of data from multiple sources, including customer inputs, external databases, and IoT devices (if consented). This data is fed into Maya, which employs machine learning algorithms to analyze and extract meaningful insights.

2. Risk Assessment and Pricing: Maya’s AI algorithms assess risk factors associated with each policy applicant in real-time and analyzes historical data, geographical factors, property details, and even behavioral patterns. Maya can accurately assess risks associated with insuring a property or a renter.

3. Automation of Underwriting Decisions: Lemonade’s AI-driven approach automates underwriting, speeding up processes and ensuring consistent, fair decision-making.

4. Enhanced Customer Experience: Lemonade’s AI enhances customer experience with quick, personalized insurance solutions, offering instant quotes and approvals.

5. Profitability and Risk Management: By leveraging AI for underwriting, Lemonade improves risk selection, leading to accurate pricing and enhanced profitability.

Impact:

Lemonade’s use of Generative AI in underwriting has revolutionized efficiency and customer satisfaction, disrupting traditional models. By refining AI models and expanding data inputs, Lemonade optimizes risk assessment and profitability, maintaining a competitive edge in the digital insurance marketplace.

Reference:

https://mihup.ai/generative-ai-in-insurance-industry/

ICICI LOMBARD General Insurance: Responsive and Intelligent Assistant

ICICI Lombard General Insurance is one of India’s leading private sector General Insurance companies. They offer a wide range of insurance products, including motor, health, travel, home, and more. Let’s delve into the case study of ICICI Lombard’s AI strategy, focusing on the commercial tools and platforms used, the implementation of Generative AI, and the impact it has had on their operations.

Tools and Platforms Used:

1. Cloud Computing Platforms:

- AWS (Amazon Web Services): Robust cloud infrastructure, scalability, and data management capabilities.

- Microsoft Azure: Used for Enterprise Solutions and integration capabilities with other Microsoft products.

2. NLP-Enabled Chatbot:

- RIA (Responsive and Intelligent Assistant): ICICI Lombard’s NLP-enabled chatbot with generative AI capabilities; assists customers in policy purchase, renewal, and claim intimation.

3. Data Lakes and AI/ML Tools:

- Data Lakes: Built on AWS or Azure, these data lakes store vast amounts of structured and unstructured data, enabling advanced analytics and AI/ML applications.

- AI/ML Tools: Tools such as Amazon SageMakeror Azure Machine Learning could be used for building, training, and deploying machine learning models.

4. Mobile Application:

- IL TakeCare App: Allows customers to file vehicle insurance claims without third-party intervention.

Implementation of Generative AI:

- Migration to Cloud: ICICI Lombard migrated 170 applications, 1,000 servers, and four petabytes of production data to the cloud which facilitated the use of advanced AI, ML tools available on cloud platforms.

- Development of RIA: RIA an NLP Chatbot, uses NLP and AI to provide accurate, relevant responses to customer queries.

- Integration with IL TakeCare App: Integrates AI to allow customers to file vehicle insurance claims directly.

- Project Orion: Aims to modernize legacy core backend systems to complement the front-end cloud-native systems integrating AI/ML solutions to enhance process efficiency and build data-backed solutions.

Impact:

1. Increased Efficiency

2. Improved Customer Service

3. Enhanced Data Management

4. Modernized Systems through Project Orion

This case study illustrates how ICICI Lombard General Insurance has successfully implemented Generative AI and the impact it has had on their customer services.

Reference:

https://www.cio.inc/icici-lombards-ai-strategy-automates-customer-services-a-25256

Anthem Inc: Enhancing Claims Management through Generative Models

Anthem Inc., a leading U.S. health insurer, faced rising claims and costs, prompting a shift to Generative AI for claims management. Partnering with Google Cloud, Anthem uses AI to analyse data, detect fraud, and personalize customer experiences, training bots to handle claims, client concerns, and medical histories for improved care.

Implementation of Generative AI:

Anthem Inc. deployed advanced Generative AI models across its claims management operations to streamline workflows, enhance efficiency, and improve accuracy in claims processing. Here’s how Anthem implemented Generative AI to revolutionize claims management:

1. Automation of Claims Processing: Anthem’s AI-driven approach automates the initial triage and processing of claims using natural language processing (NLP) algorithms.

2. Claims Validation and Fraud Detection: Anthem’s AI analyzes claims data in real-time, validating patterns and flagging fraud, accelerating adjudication.

3. Enhanced Efficiency and Cost Savings: Anthem’s AI automation reduces operational costs, accelerates claims processing, and enhances customer satisfaction and retention through faster settlements.

4. Integration with Existing Systems: Anthem integrated Generative AI into claims management, ensuring legacy system compatibility and enhancing data analytics and predictive modeling capabilities.

5. Scalability and Adaptability: Anthem’s scalable AI claims management efficiently handles growing claim volumes, maintaining accuracy and service quality.

Impact:

Anthem Inc.’s adoption of Generative AI in claims management has yielded substantial benefits across multiple fronts. By automating and optimizing processes through AI-driven technologies, Anthem has achieved:

- Improved Operational Efficiency

- Enhanced Fraud Detection

- Cost Savings

- Enhanced Customer Experience

By leveraging Generative AI to innovate claims management practices, Anthem Inc. demonstrates leadership in harnessing technology to drive operational excellence and deliver value to its stakeholders in the healthcare insurance market.

This case study illustrates how Anthem Inc. has successfully implemented Generative AI to revolutionize claims management, significantly improving efficiency, accuracy, and cost-effectiveness in processing health insurance claims in the United States.

Reference: https://www.lyzr.ai/generative-ai-insurance/

Swiss Re: Using AI for Real-time Risk Monitoring

Swiss Re leveraged Generative AI for real-time risk monitoring to address challenges in timely insights and proactive interventions in commercial insurance. Swiss Re’s Parametric Flight Delay Compensation is built on an AI model that can predict flight delays, uses more than 200 million historical data points, and the machine-learning capability of the pricing engine allows for rate adjustments, based on data from over 90,000 flights per day. The third avenue is, claims that it can help with computer vision that can reduce car accident fraud and detect driving style. Taking advantage of the confluence of edge computing and AI, an Italian startup has been granted a patent to record the front visual panorama of a moving vehicle, identify the driver’s driving style, and certify the accident by recording its dynamics.

Implementation of Generative AI:

Swiss Re implemented advanced Generative AI technologies to monitor and analyze real-time data feeds from a variety of sources, including IoT devices, environmental sensors, and financial markets. Here’s how Swiss Re leveraged Generative AI to enhance real-time risk monitoring:

1. Data Integration and Analysis: Swiss Re integrated IoT, environmental, geological, and financial data for real-time risk and vulnerability assessment.

2. Machine Learning Algorithms: Swiss Re’s machine learning algorithms analyze streaming data to detect anomalies, identify risks, and predict losses.

3. Predictive Analytics and Scenario Modeling: Swiss Re’s AI used predictive analytics to simulate risks, aiding managers in proactive risk mitigation decisions.

4. Early Warning Systems: Swiss Re’s AI-driven early warning systems alert risk managers to critical changes, enabling swift insurance adjustments.

5. Continuous Improvement and Adaptation: Swiss Re refined AI models with new data, improving algorithms and predictive accuracy for adaptive risk monitoring.

Impact:

Swiss Re’s adoption of Generative AI for real-time risk monitoring has yielded significant benefits in enhancing risk management capabilities and operational efficiencies:

- Proactive Risk Management

- Improved Decision-making

- Enhanced Customer Value

- Competitive Advantage

Through the strategic deployment of Generative AI technologies, Swiss Re demonstrates its commitment to harnessing cutting-edge technologies to anticipate, mitigate, and manage risks effectively in the fast-paced and complex landscape of commercial insurance.

This case study illustrates how Swiss Re has successfully leveraged Generative AI for real-time risk monitoring, enabling proactive risk management and delivering enhanced value to commercial property insurance clients globally.

Reference:

https://www.reinsurancene.ws/swiss-re-reimagines-the-uses-of-ai-for-the-re-insurance-industry/

Challenges and Considerations

Despite the transformative potential of Generative AI in insurance, several challenges and considerations must be addressed to maximize its benefits:

- Ethical Implications: The use of AI in insurance raises ethical concerns regarding data privacy, algorithmic bias, and the fair treatment of policyholders.

- Regulatory Challenges: Insurers must navigate regulatory frameworks that govern the use of AI in underwriting, claims processing, and customer interactions.

- Integration and Adoption: Integrating AI technologies into existing IT infrastructures and workflows requires significant investment in training, infrastructure upgrades, and change management initiatives.

Future Outlook

Future Outlook

The integration of Generative AI technologies is set to revolutionize the insurance industry, enhancing risk assessment, underwriting automation, and customer engagement through trends like explainable AI, federated learning, and AI-driven dynamic pricing models. By collaborating with technology partners, insurers can leverage Generative AI to boost operational efficiency, improve risk management, and deliver superior customer experiences.

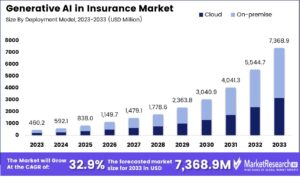

The global Generative AI in Insurance Market is projected to grow from USD 460.2 Mn in 2023 to USD 7,368.9 Mn by 2033, driven by the demand for advanced technologies and growth in the banking sector. Generative AI uses models like GANs and VAEs to analyze data and refine insurance practices.

Reference: https://marketresearch.biz/report/generative-ai-in-insurance-market/

Conclusion

Generative AI has been rampant in multiple industries and in the Insurance Industry, this technology represents a paradigm shift in how insurers assess the risks, underwrite policies, process the claims, and interact with customers. By leveraging advanced machine learning algorithms and data analytics capabilities, insurers can unlock a new set of opportunities for innovation, efficiency, and growth in an increasingly competitive marketplace. As the insurance industry continues to evolve, the strategic adoption of Generative AI will be essential for insurers to stay ahead of the curve, mitigate risks effectively, and deliver value-added services that meet the evolving needs of policyholders.