Change is sweeping through our world at an unprecedented pace, eclipsing the rapid transformations seen in any historical era. The convergence of shifts in climate, technology, workforce dynamics, and societal expectations, alongside the backdrop of macroeconomic and geopolitical fluctuations, is compelling businesses globally to overhaul their technological infrastructure, products, services, business models, and organisational culture. This metamorphosis is not solely driven by the pursuit of profitability but is a crucial response for enterprises to remain relevant and ensure their survival.

The insurance industry stands as no exception to this transformative wave. In fact, these dynamic forces colliding could serve as the impetus for a profound reinvention, reshaping not only how the industry conducts its operations but also redefining its intrinsic purpose and societal role. This adaptability is becoming more than a strategic choice—it’s a vital necessity for sustained existence.

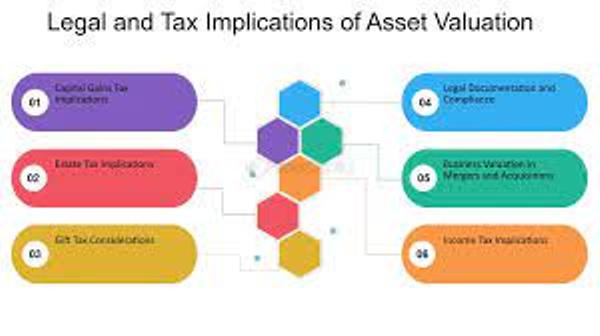

In the complex landscape of risk management, asset valuation is more than a routine procedure—it’s the vital force that pulsates through the veins of the insurance industry. Its importance goes beyond mere numerical precision; it actively molds decision-making processes and strengthens financial stability across various sectors.

Asset Valuation at the Core of Insurance Strategy

The delicate interplay between risk and value lies at the heart of the insurance industry. Asset valuation determines coverage limits, frames premiums, and secures the foundation of businesses against unforeseen adversities. According to industry data, precise asset valuation not only ensures optimal coverage but also leads to a reduction in premiums.

Finance & Banking: The Strategic Dance of Valuation and Risk

In the realm of finance, the symbiotic relationship between asset valuation and insurance takes centre stage. Accurate valuations become the bedrock upon which sound financial decisions are made. Recent industry reports underscore the crucial role of standardised valuation practices and heightened transparency in fostering a resilient financial ecosystem and shaping effective risk management strategies.

Manufacturing and Supply Chain Dynamics: Stabilising Forces in Valuation

In the intricate manufacturing and supply chain dynamics landscape, the valuation of tangible assets emerges as a pivotal force, deeply integrated into operational decision-making. Focused primarily on machinery and inventory, this valuation process serves as a stabilizing factor, offering manufacturers valuable insights for strategic choices and risk assessments.

Machinery valuation extends beyond its monetary worth, providing manufacturers with a roadmap for effective decision-making. This assessment aids in understanding the depreciation or appreciation of equipment, guiding timely maintenance or upgrades. Proactive management of machinery valuation and budgeting accordingly ensures operational continuity, minimizing the risk of unexpected breakdowns that could disrupt the supply chain.

Inventory valuation becomes a cornerstone for financial health evaluation within manufacturing industries. Accurate valuation guides manufacturers in optimizing stock levels, preventing overstock or shortages and hence production planning. This precision in inventory management contributes to streamlined production cycles, reducing the risk of supply chain bottlenecks.

The significance of tangible asset valuation becomes even more pronounced in times of technological advancements and market fluctuations. Embracing standardized frameworks ensures a consistent and accurate assessment, allowing manufacturers to adapt swiftly to changesand managethe sudden change in capital expenses. This standardized approach fosters resilience by providing a common language for stakeholders, facilitating collaboration and risk mitigation strategies.

In essence, for manufacturing industries, tangible asset valuation is not just a financial metric; it is an essential strategic tool. It acts as a stabilizing force, providing the necessary insights for informed decisions and risk management within the dynamic supply chain environment. As technology continues to evolve, standardized tangible asset valuation practices become crucial for maintaining stability and enhancing operational efficiency in the manufacturing sector.

Real Estate: Valuation Beyond Market Worth

The real estate industry finds itself at the nexus of valuation and insurance, where accurate valuation of properties becomes a crucial factor in insurance coverage. Collaboration between real estate appraisers and insurers is pivotal for comprehensive risk mitigation. Industry data underscores the critical role of accurate valuations in compensating financial lossesdue to property-related risks strategically.

Healthcare: Precise Valuation, Robust Healthcare

In the healthcare industry, fixed asset valuation is indispensable for financial management, strategic decision-making, and regulatory compliance. Accurate valuation ensures transparent financial reporting, crucial for regulatory adherence and building stakeholder trust. It plays a pivotal role in optimizing resource allocation, preventing unnecessary expenses, and enhancing overall cost-effectiveness. Asset lifecycle management is streamlined, guiding timely maintenance and upgrades to support uninterrupted patient care. Proper valuation is essential for determining insurance coverage and mitigating financial risks associated with equipment breakdowns. Compliance with healthcare standards is maintained through precise valuation, ensuring alignment with quality and regulatory requirements. From a healthcare perspective, it’s a strategic imperative for operational efficiency, fiscal responsibility, and maintaining high-quality patient care standards.

Bridging Gaps: Strides in Valuation Practices

Acknowledging the critical nature of accurate asset valuation, commendable strides have been taken. Industry collaborations, technological innovations, and regulatory interventions have enhanced valuation methodologies and transparency. Yet, gaps persist, especially in the standardisation of valuation practices for intangible assets. Recent industry trends highlight the need for an unwavering commitment to refine methodologies and foster interdisciplinary collaboration to comprehensively bridge these gaps.

Charting the Course in an Evolving Landscape: Technology and Collaboration as Catalysts

Looking ahead, integrating technology and collaborative efforts will be the harbinger of change in asset valuation within insurance and risk management. Blockchain, artificial intelligence, and industry-specific valuation standards are poised to redefine how assets are valued and insured. For insurance broking and risk management companies, staying at the forefront of these developments is not just a strategic choice; it is an ongoing commitment to unlocking, safeguarding, and maximising value in an ever-evolving risk landscape across diverse industries.

In conclusion, asset valuation is not just a technicality but a strategic pillar that permeates every facet of the insurance industry, providing the foundation for informed decision-making and resilient risk management. As industries evolve, so must the approaches to asset valuation, and embracing technological advancements and collaborative initiatives is the key to staying ahead in this dynamic landscape.