“A key development at New India Assurance is our continued focus on digital transformation, enhancing customer experience through technology-driven initiatives”

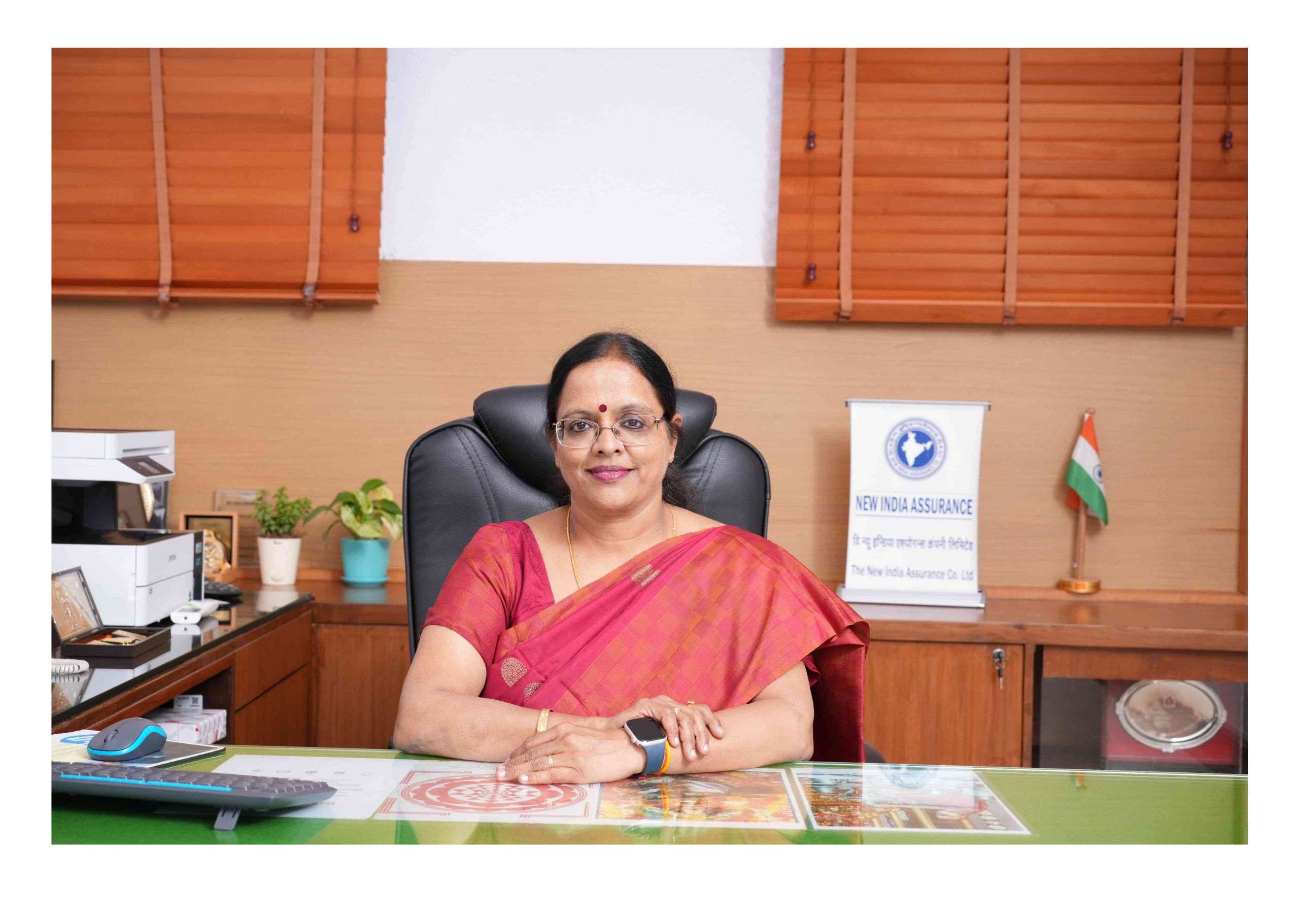

About Ms. Girija Subramanian

Mrs Girija Subramanian has the unique distinction of heading two of India’s major insurance companies as Chairman cum Managing Director in quick succession. On 19th June 2024, she joined as chairman and managing director (CMD) of the largest general insurer, New India Assurance Co.Ltd. Mrs Subramanian joined as CMD of Agriculture Insurance Company of India Limited in September 2022 which she held till the time she joined New India Assurance Co.Ltd. Mrs Subramanian carries with her experience of more than 35 years in the industry and has discharged many coveted responsibilities with consummate elan. Mrs Subramanian holds a bachelor’s degree in statistics. She is a fellow member of the Insurance Institute of India and also an associate member of the Chartered Insurance Institute, (ACII) London.

Way back, in 1988 She started her career as a direct recruit officer in GIC Re which was then known as GIC of India. In a career spanning over three decades, she worked in reinsurance departments across various lines of business, including aviation, life, health, and property classes.

While in GIC, she played a crucial role in the execution of the management decision to adopt average industry burn rates for fire insurance as minimum rates for proportional reinsurance cessions to GIC Re by Indian General Insurance companies. – which saw a significant increase in price across the industry. The initiative saw rate improvements in India and helped improve the ICR of most companies- a great learning curve in her career. Quintessentially a team person, her efforts along with her team significantly brought down the TAT( Turn Around Time) and claims pendency at GIC Re. Online claims payment was another initiative, she remembers with a tinge of pride. The increase in life insurance market share in the GIC Re portfolio along with her team and senior colleagues was yet another effort, she remembers fondly.

Daughter of the Late Narayanan Lakshmanan, a noted actuary and academic ( he was appointed actuary of HDFC Ergo) she is the second generation in the insurance industry. A worthy daughter of a worthy father. Old-timers even today remember the late Mr Lakshmanan for his teaching acumen at NIA Pune. Her father was a big influence in her life.

Her striking simplicity, down-to-earth approach and easy accessibility leave a lasting impression. In a way, she is humility personified. A true servant-leader, who believes leading is all about serving others—subordinates, superiors, peers, stakeholders; family and friends and this leadership attribute, strikes a chord immediately with whoever she meets. She believes in customer-centricity and strives relentlessly for customer delight. A travel aficionado, she is deeply wedded to spirituality.

Q1 : New India Assurance is the largest non-life insurance company in India. What have been the key factors contributing to the company’s leadership position in the industry over the years?

A: New India Assurance’s leadership in the Indian non-life insurance sector is attributed to several key factors:

1. Extensive Legacy: Over 100 years of experience, with a strong foundation since 1919, has built trust and credibility among stakeholders.

2. Pan-India Presence: A robust network of offices and agents ensures wide accessibility across urban and rural areas.

3. Diverse Product Portfolio: Catering to various sectors with tailored products, from retail to corporate insurance.

4. Global Footprint: Operations in 25 countries, showcasing expertise in both domestic and international markets.

5. Financial Strength: Consistent growth in Gross Written Premium (GWP) and robust solvency ratios affirm stability.

6. Technology Integration: Investments in digital platforms enhance customer experience and operational efficiency.

7. Strong Partnerships: Collaboration with government schemes and global reinsurers reinforces market position.

8. Customer-Centric Approach: Emphasis on claims settlement and innovative offerings ensures high customer retention.

These elements collectively solidify New India Assurance’s market dominance.

Q2: The insurance sector in India is rapidly evolving. How is New India Assurance adapting to these changes, particularly in terms of digital transformation and technological advancements?

The Company has been actively adapting to the rapid digital transformation and technological advancements within the insurance sector. Here are several ways in which the company is evolving:

1. Digitalization of Services : New India Assurance has been integrating digital platforms to streamline customer interactions and improve efficiency. The company has online services for policy issuance, claims processing, and renewals. This digital push not only enhances customer convenience but also reduces paperwork and processing time.

2. Mobile App and Online Platforms : Our company offers a state of the art Customer portal, mobile app and a user-friendly website that allow customers to easily buy insurance policies, track claims, make payments, and access policy documents. These platforms provide 24/7 access, enabling customers to manage their policies without needing to visit physical branches.

3. Al and Automation in Claims Processing : To improve operational efficiency and speed up the claims settlement process, New India Assurance has incorporated Artificial Intelligence (Al) and automation. Al-powered tools are used for faster claims assessment and decision-making for Motor OD claim surveys for claims up to RS. 50,000/-.

4. Partnerships with Insurtech Startups : To keep pace with innovation, New India Assurance has been forming partnerships with lnsurtech Startups. These collaborations aim to leverage cutting-edge technologies such as machine learning, Al, and data analytics to develop new, innovative insurance products and improve customer engagement.

5. Improved Customer Engagement with Chatbots : To further improve customer service, New India Assurance has incorporated Al-driven chatbots on its digital platforms especially NIACL website. These chatbots are designed to provide instant responses to customer queries, guide users through insurance-related processes, and assist with policy management.

6. Digital Sales Channels : The company has embraced digital sales channels, including tie-ups with online aggregators and distribution platforms. This approach allows them to reach a wider audience, including younger, tech-savvy customers who prefer online transactions over traditional channels.

Web Aggregators integration, Customer portals, Broker portals, Bancassurance, & Dealers Portals are part of these advancements.

7. Customer-Centric Innovations : The company is focusing on delivering customized insurance solutions based on customer needs. Through digital channels and data analytics, New India Assurance tailored policies to individual risk profiles, offering more personalized and relevant products.

“New India Assurance has been integrating digital platforms to streamline customer interactions and improve efficiency. The company has online services for policy issuance, claims processing, and renewals.”

8. WhatsApp enabled services : WhatsApp Service with functionalities like Downloading Policy Document, Claim status, product information, hospitals & garages list and Live Chat. All support is available in 6 languages.

9. Digital Marketing : Insurance sector is seeing cut throat competition now and NIACL is adapting itself to enhance its presence in digital marketing via advertisements in search engines, increasing lead conversions through social media marketing, short marketing reels to increase awareness among new and young prospects. NIACL is also planning to get into influencer marketing and analysis of active user engagement, Al powered content personalisation.

1o. Ministry and Regulatory Compliances corresponding to technological advancements :

- NIACL has been on boarded into the Account Aggregator ecosystem which will facilitate it to rationalise decision making in terms of premium personalisation etc going ahead.

- NIACL is in process of onboarding into ONDC (Open Network for Digital Commerce) ecosystem which will enable faster deployment of products in different seller platforms going ahead

- NIACL is in process of implementing IFRS 17 accounting system

- NHCX (National Health claim exchange) integration. NIACL begun processing claims on NHCX platform. Claims have been processed across 5-6 hospital.

- Jan Suraksha portal integration completed for PMSBY. On boarding of Customers, Claim Processing for partner banks through Jan Suraksha Portal has started.

- Digitisation of Policy. NIACL is exploring the Integration with IR (Insurance Repository) system to provide policyholders a facility to keep insurance policies in electronic form and to undertake changes, modifications and revisions in the insurance policy.

” Insurance Sector is seeing cut throat competition now and NIACL is adapting itself to enhance its presence in digital marketing via advertisements in search engines, increasing lead conversions through social media marketing , short marketing reels to increase awareness among new and young prospects”

11. Cybersecurity Measures : As digitalization increases, so do the risks related to cybersecurity. New India Assurance is ISO 27001 certified. We have invested in robust cybersecurity infrastructure to protect customer data and prevent fraud. They use advanced encryption methods and secure payment gateways to ensure the safety of financial transactions.

Q3: In recent years, there has been a growing focus on increasing insurance penetration in rural and semi-urban areas. What initiatives has New India undertaken to expand its reach in these regions?

New India’s recent initiative pertaining to Rural Insurance is as under:

1. National Livestock Mission : The Department of Animal Husbandry & Dairying, Government of India is implementing the scheme of National Livestock Mission since the financial year 2014¬15. In view of the present need of the sector the NLM scheme has been revised and realigned from F/Y 2021-22. The revised scheme of National Livestock Mission (NLM) aims towards employ-ment generation, entrepreneurship development, increase in per animal productivity and thus targeting increased production of meat, goat milk, egg and wool under the umbrella scheme Development Programme. The excess production will help in the export earnings after meeting the domestic demands. The concept of NLM Scheme is to develop the entrepreneur in order to create the forward and backward linkage for the produce available at the unorganized sector and to link with the organized sector.

The New India Assurance is contributing to increasing penetration in rural and semi-urban areas by participating in the National Livestock Mission by doing cattle and other livestock’s insurance in Uttar Pradesh, Haryana, Kashmir and Rajasthan. All the Horses, Ponies, and Mules of the Amarnath Yatra are also insured by New India.

New India provides insurance coverage to SHGs, Micro Finance Institutions. All District Level Schemes (cattle, livestocks, horticulture) pertaining to rural areas and BPL families are taken care of and provided insurance coverage.

2. Pradhan Mantri Matsya Kisan Samridhi Soh Yojana: The Union Cabinet, Chaired by Prime Minister Shri Narendra Modi approved the “Pradhan Mantri Mastya Kisan Samriddhi Sah-Yojana (PM-MKSSY)”.This is a Sub scheme under Central Sector Scheme “Pradhan Mantri Matsya Sampada Yojana (PMMSY)” aimed at formalizing the fisheries sector and supporting fisheries’ micro and small enterprises.

The New India Assurance Company has also recently launched a New India Shrimp/Prawn Insurance Policy keeping in mind the requirements of the aquaculture farmers and will participate on the NFDB Portal for providing the cover to small and medium scale fishermen.”

Q4: With climate change leading to an increase in natural disasters, how is New India Assurance addressing the challenges of underwriting and claims management for catastrophic risks?

A: Climate change is now a Global Phenomenon which every country tries to address in the form of various Initiatives to make it Net Zero. Insurance Industry plays an important role in encouraging and supporting the Industries which take initiatives to reduce the carbon emission. lt is a challenge for the entire Insurance community. However we New India assurance company are addressing the challenges of catastrophic risk successfully in both underwriting and claims management with the following strategies:

1. We identify the locations and the Industries which are likely to be prone for the losses and impose loss limit for CAT exposure. lt helps both Insurance companies and the Industry as well.

2. We also encourage the Industry/ client to adopt the loss prevention methods

3. We have recruited new engineers who are advised to do Risk Inspection of the Risk to understand the risk and advise methods to minimise the loss, especially storage risk.

4. In case of catastrophic claims, immediately we appoint a team at the location for speedy settlement of the claim.

5. Catastrophic claims are monitored on a weekly basis for settlement of the claim to the needy in their crisis.

6. As a company we have noticed more than 90% CAT claims in India are uninsured and we are taking steps for more penetration by devising the parametric cover, and Bundled product so that more people have a policy .

Q5: Customer expectations have shifted dramatically with the rise of digital platforms. How is your company ensuring a seamless and customer-friendly experience for policyholders in the digital age?

A: New India Assurance has been proactive in adapting to the rapidly changing expectations of customers in the digital age. As the demand for seamless, convenient, and customer-friendly services increases, the company has focused on several strategies to enhance the customer experience through digital transformation:

1. User-Friendly Digital Platforms : To meet the needs of digitally-savvy customers, New India Assurance has developed a robust online presence, including a website, customer portals and mobile app. These platforms allow customers to easily purchase policies, renew them, and manage their accounts.

2. 24/7 Customer Support with Al Chatbots : Under-standing the importance of round-the-clock service, New India Assurance has integrated AI-powered chatbots into their digital platforms specially NIACL website.

3. Simplified Claims Process : One of the major areas where New India Assurance has streamlined the customer experience is in claims processing. Customers can easily intimate claims through the digital platforms, upload necessary documents, and track the status of their claims. Al based claim automation for Motor OD claim surveys up to RS. 50,000/-

4. Online Policy Issuance and Instant Renewals : With state of the art Customer portal and NIA website, New India Assurance’s online policy issuance system, customers can instantly receive their policies after purchase or renewal. The digital policy documents are easily accessible via the website or WhatsApp, reducing paperwork and enhancing convenience.

5. Seamless Payment Options : Recognizing the importance of hassle-free payments, New India Assurance offers multiple online payment options, including credit/debit cards, UPI, net banking, and mobile wallets, These flexible payment methods ensure that customers can make premium payments easily and securely, without having to rely on traditional methods.

6. WhatsApp enabled services : WhatsApp Service with functionalities like Downloading Policy Document, Claim status, product information, hospitals & garages list and Live Chat. All support is available in 6 languages.

7. Real-Time Updates and Notifications : To keep policyholders informed, New India Assurance sends real-time notifications for policy updates, payment reminders, claim status, and other important alerts. This proactive communication helps customers stay on top of their insurance needs and reduces the risk of missed payments or unresolved claims.

8. NIACL Call Centre : NIACL has established a State of the art 24×7 Call Centre to cater to the all business need, support, and services to our customer. The survives are available in 6 languages for more personalised connect with the customer.

9. Data Security and Privacy : As digital transactions become more prevalent, the company has placed a strong emphasis on data security. New India Assurance uses advanced encryption and secure data storage systems to protect customer information from potential breaches. This commitment to privacy helps build trust with customers in the digital environment.

10. Educational Initiatives through Digital Content : To ensure that customers fully understand their policies and the insurance process, New India Assurance has invested in creating educational content available on our website and customer portals. This includes Manuals, FAQs, video tutorials, that help demystify insurance and guide policyholders through the process of buying, managing, and claiming insurance.

Q6: As competition intensifies in the non-life insurance market, what strategies does New India have to retain its market leadership while balancing profitability and growth?

A: New India Assurance employs a multi-pronged strategy to maintain its market leadership while balancing profitability and growth:

Customer-Centric Product Development: Offering innovative and tailored insurance solutions to meet diverse customer needs.

Digital Transformation : Enhancing customer experience and operational efficiency through technology adoption.

Optimized Distribution Network: Strengthening agent networks, bancassurance, and digital sales channels for deeper market penetration.

Risk Management: Prudent underwriting practices and claims management to sustain profitability.

Geographical Diversification: Leveraging its global presence in 25 countries to diversify risks and revenue streams.

Focus on Emerging Segments: Expanding in areas like health, MSME insurance, and cyber risk policies.

Q7: With ESG (Environmental, Social, and Governance) becoming a priority for businesses worldwide, how is New India Assurance incorporating ESG principles into its operations and product offerings?

A: At New India Assurance, we recognize the critical importance of Environmental, Social, and Governance (ESG) principles in shaping a sustainable future. Our commitment to ESG is reflected in various aspects of our operations and product offerings:

Environmental Stewardship: We are dedicated to reducing our environmental impact through energy-efficient practices and promoting digital transactions to minimize paper usage. Our goal is to significantly lower our carbon footprint and contribute to a greener planet. Organizational-wide initiatives, including videoconferencing and energy-efficient measures, aim to reduce energy consumption. Additionally, we have undertaken CSR projects focused on reducing greenhouse gas emissions.

Social Responsibility: Our initiative “Insurance for All by 2047” aims to ensure every individual in India is financially protected by the nation’s centennial year of independence. This goal highlights our dedication to making insurance accessible and affordable for all, especially the underserved. We innovate in product offerings, enhance digital outreach, and collaborate with government bodies to create an inclusive insurance ecosystem, contributing to economic resilience and social equity.

“Bima Vistaar” extends insurance coverage to remote and underserved areas, offering tailored products for rural populations, small businesses, and the informal sector. “Bima Sugam” simplifies the insurance buying process through an integrated digital platform, empowering consumers to make informed decisions.

Robust Governance: At New India Assurance, our Enterprise Risk Management plays a pivotal role in identifying and mitigating risks, including those related to ESG factors. Continuous monitoring ensures smooth operations and enhances overall performance. The Board oversees our risk management framework, providing strategic guidance and making informed decisions to mitigate potential risks. This collaborative approach fosters a culture of risk awareness and accountability throughout the organization. Our holistic approach to ESG concerns, such as climate change and socio-equity, is integral to our strategy, ensuring we contribute meaningfully towards a sustainable world.

Through these initiatives, New India Assurance is committed to driving positive change and fostering a sustainable, responsible business environment.

Q8: Fraud prevention and claims management are critical aspects of non-life insurance. What technologies or practices has New India adopted to improve efficiency and transparency in these areas?

A: Fraud prevention and claims management are indeed pivotal in the general insurance sector, as they safeguard against financial losses and preserve the integrity of the insurance process. Effective fraud detection and claims handling not only protects the company’s resources but also ensures fair premiums for policyholders and maintain trust in the insurance system. As fraudulent activities become mare sophisticated, we at New India are continually evolving our strategies to mitigate risks and manage claims effectively.

Below are some of the practices / technologies which hove been developed to enhance fraud prevention and claims management. We are continuously fine tuning these techniques to factor in experiences and learnings:

1. Obtaining KYC of customers/Firm before issuing the policy

2. Awareness mailers/SA/IS are being sent to employees as well as customers encouraging them to adhere to fraud prevention practices.

Claims Management:

Transparency and Efficiency in settling claims ensures customer satisfaction. Following are the few initiatives in this regard:

1. Automatic appointment of surveyor for motor OD claims- surveyors from different categories will be appointed based on different claim amount limits.

2. Enabling claim registration online through Agent portal/customer portal/call centre/employee portal etc.

3. Implementation of settling claims based on Digital Survey report is underway which makes claims settlement faster.

4. Using tools to evaluate factors like hospital bills, and proximity claims to identify potential suspicious claims, fraudulent claim documents etc. which will then trigger an investigation.

5. Regular audit of empanelled TPAs to ensure proper claim settlements.

6. Regulatory Compliance: Implement tools / process to maintain compliance with industry regulations, contributing to fraud prevention efforts. (specifically for monitoring the Red Flag indicators provided by Financial Intelligence Unit (FIU) for General Insurance).

Q9: As the Chairperson, what is your vision for New India Assurance over the next 5 years? How do you plan to navigate the challenges and opportunities in the dynamic insurance landscape?

A: My vision for New India Assurance over the next five years is to solidify our position as a global leader in non-life insurance, driven by innovation, customer-centricity, and sustainability. We aim to harness digital transformation to enhance operational efficiency and deliver seamless customer experiences while expanding our global footprint in strategic markets.

To navigate challenges such as regulatory changes, evolving customer expectations, and climate-related risks, we will focus on agility, leveraging data analytics, and fostering partnerships to co-create solutions. At the same time, we will capitalize on opportunities in underserved markets and emerging risk areas like cyber and parametric insurance.

Our overarching goal is to remain a trusted partner to our policyholders and stakeholders, delivering growth with integrity and resilience in an ever-changing insurance landscape.

Q10: Any other development at Newindia, you would like to highlight?

A: A key development at New India Assurance is our continued focus on digital transformation, enhancing customer experience through technology-driven initiatives. We have strengthened our portfolio with innovative, customer-centric products. These efforts reflect our commitment to excellence and industry leadership.

Q11 : Finally, what message would you like to convey to policyholders, stakeholders, and the larger insurance community through The Insurance Times?

A: As the leading player in the insurance sector, my message through The Insurance Times is one of commitment, innovation, and collaboration. To our policyholders, I assure you that our focus remains on delivering superior service, prompt claim settlements, and innovative solutions tailored to your needs. To our valued stakeholders, we reaffirm our dedication to creating sustainable growth and long-term value, underpinned by robust governance and operational excellence. To the larger insurance community, I call for a collective effort toward innovation, inclusivity, and resilience, ensuring that our industry remains a pillar of security and progress in a rapidly evolving world.