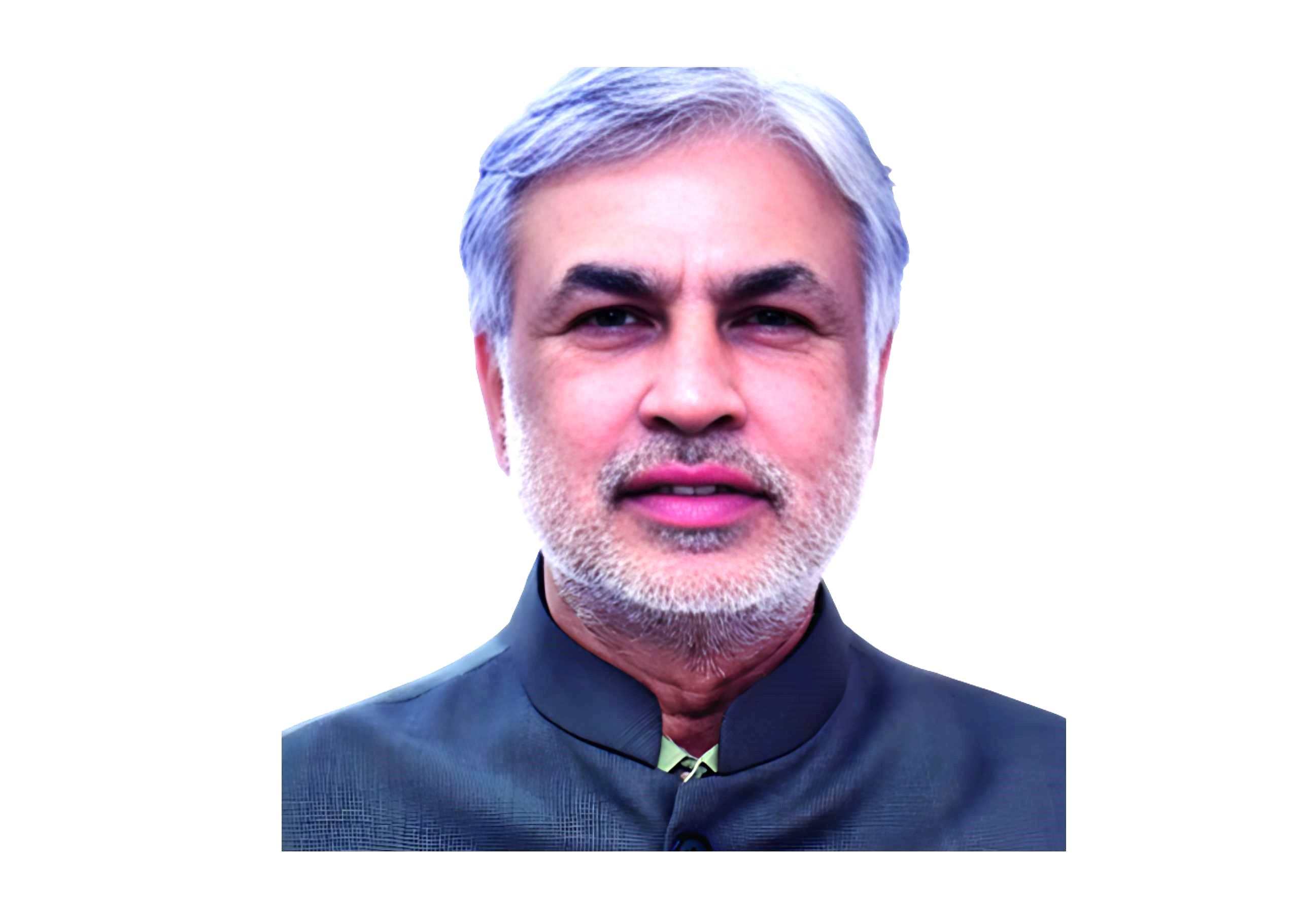

About Mr. Satpathy

Shri S N Satpathy had joined Insurance Institute of India as Secretary General on 19th September 2022 on deputation from Life Insurance Corporation of India. Prior to the current assignment, he was Additional Director of LIC Management Development Centre (MDC), Mumbai, the apex training centre for middle to senior level executives of LIC.

He has 33 years of service experience in LIC, the major and only PSU life insurer of the country, having joined LIC as 17th batch Direct Recruit officer in September 1989. During this more than three decades experience in Life Insurance Corporation, he had successfully handled life insurance marketing and operations spread over 6 states falling under 7 Divisions and 4 Zones of LIC of India, both at operational level of Branches, Divisions and Zones. He has the experience of conventional marketing of life insurance, marketing through alternative channels of distribution including Bancassurance and Direct Marketing. He was also in-charge of Pension & Group business operation in Mumbai.

He had effectively performed as National Relationship Manager to promote the Bancassurance business through three PSU Bank partners, headquartered at Mumbai and Pune.

He is a Post Graduate in Agriculture Science, having Fellow of Insurance Institute of India (FIII) and specialized diploma in Health Insurance.

Q. IRDAI has been very proactive under its new Chairman and it has taken the pledge of Insurance for all by 2047. In its backdrop, how do you foresee growth of Insurance Sector in coming years.

A: Under the visionary leadership of IRDAI Chairman who has initiated a series of regulatory reforms in the sector, the growth of Insurance sector is very well poised to maintain a healthy growth while increasing the insurance penetration and density to catch up with the world average within next 5 years. As the country is looking forward to its AmrutKal and moving towards to become fourth largest economy in the world, the development in Insurance sector is paramount.

Q. How does the Insurance Institute of India work with insurance companies, regulators, and other industry stakeholders to drive growth and development in the industry?

A: III works with the Regulator for conducting pre-licensing training and examinations of marketing intermediaries, surveyors and TPAs working in the health space. Being a membership based organization, we use the wide network of Associate Institutes and Fellow Members across the country to support the insurance industry’s endeavors for creating insurance awareness and insurance literacy through academic engagements with many schools and colleges.

Q. Can you discuss some of the initiatives and programs that the Insurance Institute of India has undertaken in recent years to support the industry and its professionals?

A: III could play a proactive role during the pandemic period and reach out to multiple stakeholders. During this period, we could give online training to a large number of doctors and administrative professionals across India on the Pradhan Mantri Jan ArogyaBimaYojana, popularly known as Ayushman Bharat as part of a World Bank Scheme. We have collaborated with the National Institute of Disaster Management (NIDM) and delivered a series of monthly online lectures to create awareness on the importance of insurance in disaster mitigation. We do conduct online lectures for teachers of the schools affiliated with the Central Board of Secondary Education (CBSE) to build their capabilities for teaching insurance.

Q. Do you think Insurance Industry must focus more in the area of Insurance education and awareness for its employees and consumers to achieve the growth objective?

A: Insurance is essentially a knowledge based industry and both the buyers and sellers of insurance need to know what they are buying and selling, to make the insurance mechanism meaningful. III works with practically all the public and private sector insurers and reinsurers as well as all the intermediaries to build internal academic and professional competencies for them. We do this both within and outside the country. Talking about training the insured, actually, the first training that we conducted in the College of Insurance at Mumbai after the pandemic period was for a Power generation and distribution company utility from the Republic ofZambia.

Q. How does the Insurance Institute of India stay up to date with changes and developments in the insurance industry and ensure that its curriculum remains relevant and effective?

A: III has a system of revising its course material periodically. The courses are authored and reviewed by industry professionals. No doubt, it is a tedious job because the authors/ reviewers should be abreast with the latest regulatory changes and the changing market practices, as well as the necessary writing skills to communicate clearly in the written medium. As the course material is in the Self Instructional Methodology (SIM) format, we are able to give quite some precision through the course material.

Q. Can you talk about the challenges faced by the insurance industry in India and how the Insurance Institute of India can help the industry to address them?

A: As I said earlier, we are in a knowledge based industry and we try to help every single stakeholder of the insurance value chain in being more knowledgeable. Knowledgeable insurers can deliver better products and better services, while knowledgeable customers can make the industry provide better value of the insurance services delivered to them. When we look from that point of view, we do not find challenges or even competition for that matter.

Q. How does the Insurance Institute of India support the professional development of its members and help them advance their careers in the insurance industry?

A: III has a system of Life Membership for its Fellows, Associates and ordinary Members. Professional development for our members keeps happening all the while. For instance, as most of the members are busy professionals, we compile the important news about the industry over the week from all the leading publications, and send it across to our members as weekly newsletters called ‘III Insu-News’in digital form. This complimentary value-add was started in 2011 and despite the Covid-19 difficulties, we have published more than 600 issues by now. Similarly, we have been publishing the III Journal since 1974 as a service for our Members. I am happy to share that this research based Journal has been approved by UGC Care from January 2013 onwards. In addition, we conduct a number of Seminars and Webinars free of cost to empower our members academically and professionally with the latest happenings in other markets.

Q. Please tell us about the Ph. D. programme being offered by your Institute and who are eligible to enroll.

A: III has a Research Department approved by the University of Mumbai for Ph. D. Research under the Faculty of Commerce. As of now, we are having only one Research Guide and there are 3 research scholars registered under him. We are augmenting the Department’s capacity by recruiting additional faculty.

Q. Do you have any plans of expansion in any other cities in India?

A: As an institution, we exist for the needs of the insurance industry. The Institute and its College of Insurance have been operating from Mumbai from 1955 and 1966 respectively. During the last decade we opened the Kolkatacampus of the College to cater to the needs of the Eastern part of the country and neighboring countries like Bangladesh, Bhutan, Nepal, and Myanmar. As I mentioned earlier, we use digital platforms extensively to stay connected with the industry. We are not aggressive on expansion, but we are not averse to expansion as well. We rather believe in organic growth along with the industry’s needs.

Q. Insurance Industry in India is adopting technology at a fast pace. Do you plan to launch any courses integrating technological developments, AI, Blockchain etc.?

A: We use technology to be connected and to perform the roles expected from us, including eLearning, virtual classrooms, online seminars, remote proctored examinations, etc. We are aware that our expertise is in the core domain area of insurance,along with its multiple lines and multiple functions. We do not have plans to get into the core technical aspects of AI and Blockchain. However, we do integrate functional aspects of technology into our training programs such as digital marketing, data analytics, social media fraud, etc. to the extent the industry needs them.

Q. What is your current membership strength and what growth numbers do you expect in coming years.

A: We have 42825 Fellows,48200Associates and 160255 Ordinary Life Members. We keep getting new members through our Associate Institutes; they keep coming from the industry, colleges and schools. We look at growth in an organic manner.