After registering underwriting profits of S$104.5m in 2020, the profitability of Singapore motor insurers is expected to decline in 2021 due to a rise in claims, driven by an increase in road accidents and insurance frauds, says GlobalData, a leading data, and analytics company.

Swarup Kumar Sahoo, Senior Insurance Analyst at GlobalData, comments: “In Singapore, the number of accident-related fatalities has increased by 11%, whereas injuries registered a growth of 15% during January-September 2021, as compared to the same period in 2020. Subsequently, the Singapore motor insurance industry combined ratio, which decreased from 102.6% in 2019 to 87.9% in 2020 is expected to increase in 2021.”

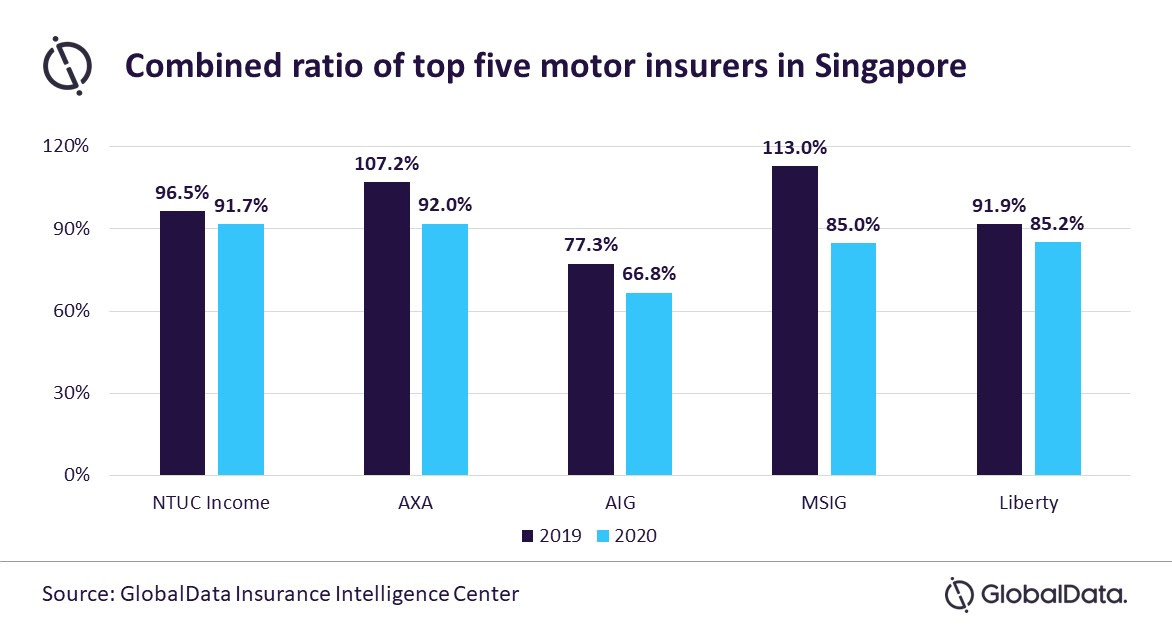

In line with the industry trends, the combined ratio of the top five motor insurers in Singapore decreased in 2020. The combined ratio of Singapore’s largest insurer NTUC Income decreased from 96.5% in 2019 to 91.7% in 2020, whereas for the second ranked AXA it declined from 107.2% in 2019 to 92.0%.

Sahoo continues: “In 2021, growth in vehicle sales, driven by economic recovery and growing demand for electric vehicles (EVs), is expected to help insurers in partially offsetting their underwriting losses. EV sales in Singapore grew by 127% during January-November 2021.”

Insurers are also adopting technology to increase sales. This includes implementation of AI-based solutions to launch innovative products such as short-term insurance and pay-as-you-go pricing system, which makes insurance flexible, affordable, and transparent for customers. This is done by installing a telematics device in the vehicle that tracks the kilometers driven and the premiums are charged as per the usage.

The use of technology for detection of fraudulent claims is another focus area for the insurers. According to the General Insurance Association of Singapore, around 20% of motor insurance claims are inflated or fraudulent. Major insurers in the country are exploring solutions to leverage technology for improving their fraudulent claim detection processes. For instance, NTUC Income has introduced ‘Orange Eye’ mobile application to submit video footage in case of an accident.

Sahoo concludes: “Singapore motor insurers are embracing for a major shift in their product offering in the coming years with the government push for EV adoption to meet the objectives of the Singapore Green Plan 2030. Increasing underwriting losses due to high accident rates and motor insurance frauds will continue to pose a challenge for insurers profitability over the next few years.”