Introduction

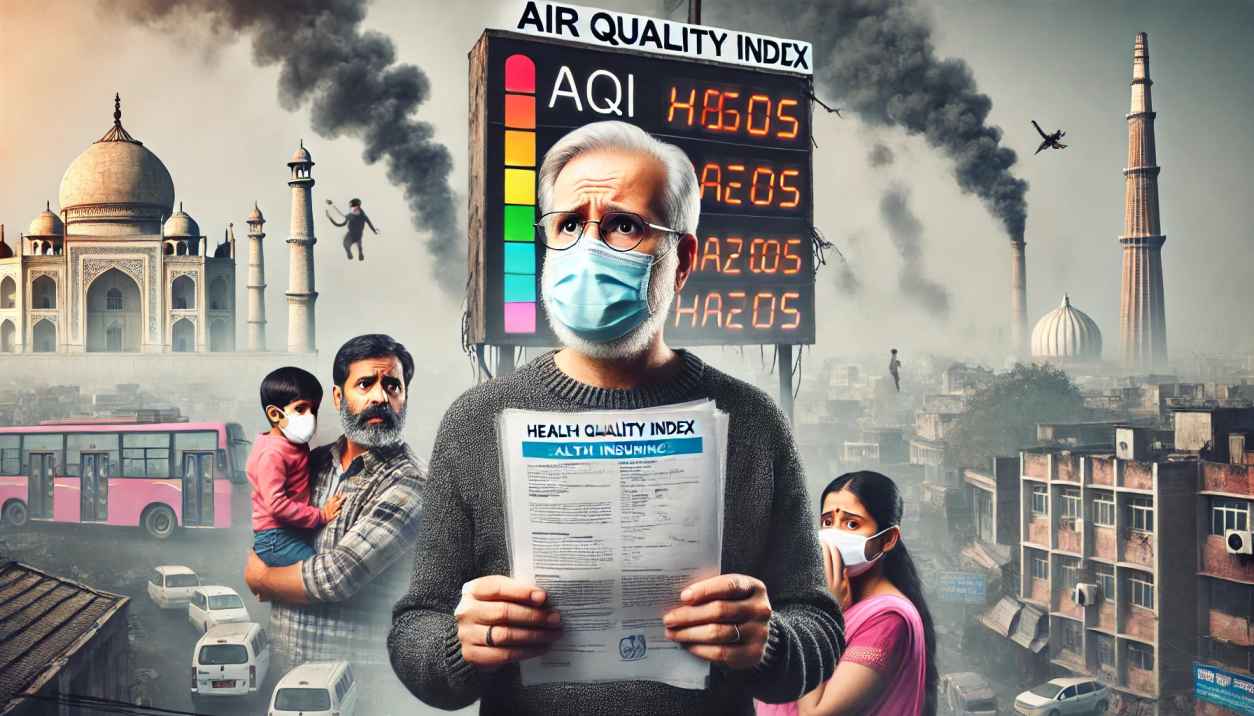

Health insurance premiums in Delhi could see a 10-15% increase as insurers consider factoring in air pollution-related health risks while pricing policies. If approved by the Insurance Regulatory and Development Authority of India (IRDAI), this would mark the first time air pollution is directly considered in determining health insurance costs in India.

Key Highlights

Air Pollution in Delhi and Its Impact on Health

- Delhi’s air quality deteriorates each winter due to vehicle emissions, industrial pollution, construction dust, and crop-burning in neighboring states.

- On November 18, 2024, Delhi’s Air Quality Index (AQI) reached 491 out of 500, posing severe health risks even to healthy individuals.

- Hospital admissions for respiratory and cardiovascular conditions such as asthma and COPD (Chronic Obstructive Pulmonary Disease) increased significantly in 2024.

Surge in Pollution-Related Medical Cases

- In the second half of 2024, respiratory-related hospitalizations rose to 18% from 5-6% in the first half of the year.

- A joint report by the Boston Consulting Group and Medi Assist found that health insurance claims for respiratory illnesses in Delhi increased by 8.3% between FY 2023 and FY 2025.

- Delhi recorded the highest rise in healthcare costs across India during this period.

Insurers Push for Pollution-Based Pricing

- Leading insurers such as Star Health, ICICI Lombard, and Bajaj Allianz General Insurance suggest that if pollution levels remain high, air quality could become a key factor in premium pricing.

- Insurers may also introduce policy clauses addressing pollution-related health risks.

- However, for approval, insurers must provide IRDAI with evidence linking toxic air to increased health insurance claims.

Rising Health Insurance Costs and GST Impact

- Currently, an annual health insurance policy covering ₹8 lakh to ₹33 lakh for a family in Delhi costs between ₹8,000 and ₹32,000.

- A premium hike could make healthcare coverage less affordable, especially for senior citizens, children, and outdoor workers, who are most vulnerable to pollution.

- The GST Council has not announced tax relief on health insurance. The current 18% GST on premiums adds to the financial burden of policyholders.

- In FY 2023-24, the Indian government collected ₹16,398 crore in GST from health and life insurance policies, with ₹8,263 crore from health insurance alone.

Conclusion

If insurers secure IRDAI approval for pollution-based pricing, Delhi could become the first Indian city to see a direct link between air pollution and health insurance costs. This move could also pave the way for premium hikes in other metro cities facing severe air quality issues. However, the increase in costs may make quality healthcare coverage more expensive for many residents.