The life insurance industry in Indonesia is forecasted to recover in 2021, driven by increased consumer confidence, according to GlobalData, a leading data and analytics company.

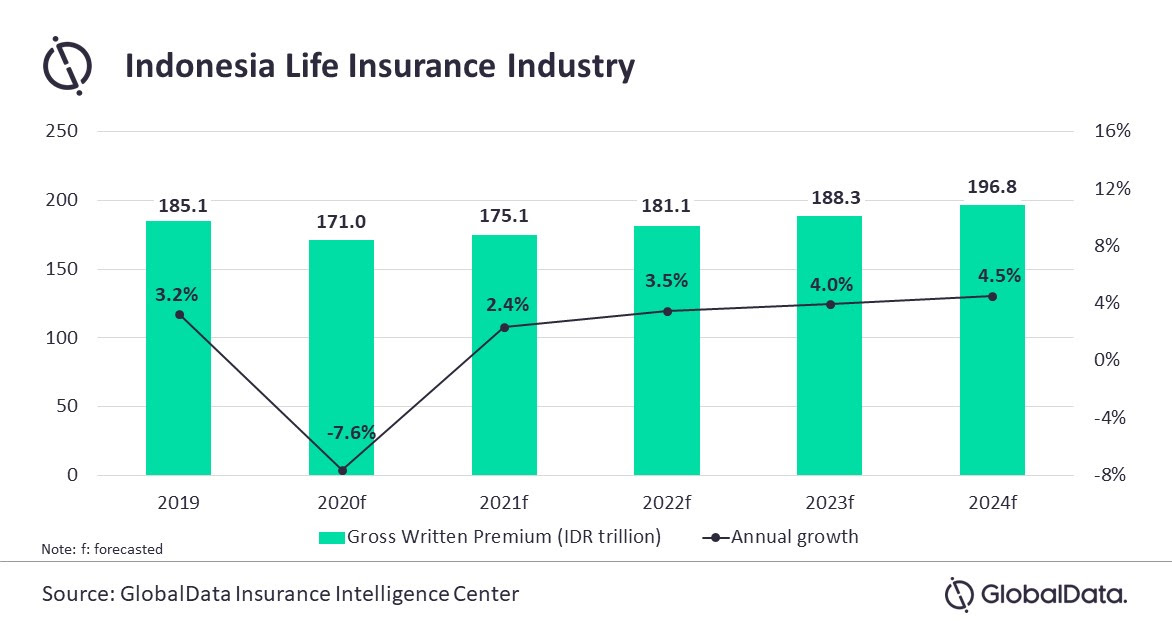

GlobalData has revised Indonesia’s life insurance forecast in the aftermath of the COVID-19 pandemic. As per the latest data, Indonesia’s life insurance industry is projected to grow from IDR185.1 trillion (US$13.1bn) in 2019 to IDR196.8 trillion (US$13bn) in 2024, in terms of gross written premium (GWP).

Pratyusha Mekala, Insurance Analyst at GlobalData, comments: “The Indonesia economy continues to face the impact of rising number of COVID-19 cases. Restrictions imposed due to the pandemic worsened the economic outlook, which is expected to derail a full-scale recovery in the life insurance segment in 2021.”

Along with the negative impact of the pandemic, decreasing consumer confidence due to the financial crisis involving select state-owned insurers in 2018-19 also impacted life insurance growth in 2020. As a result, life insurance premium declined by 7.6% in 2020 to be valued at IDR171 trillion (US$11.7bn).

To address liquidity concerns, the Financial Services Authority of Indonesia (OJK) mandated select insurers to inject additional capital. Additionally, the government issued regulation permitting foreign insurers to increase ownership in local insurance companies effective January 2020. This was previously limited up to a maximum of 80%.

Increased demand for life and health products due to the pandemic has prompted insurers to offer new products with COVID-19 specific benefits. Recovery in business activity due to the gradual reopening of the economy, and increased revenue from the bancassurance channel in the first half of 2021 has led to recovery in life insurers premium.

As per the Indonesian Life Insurance Association (AAJI), the industry registered a net profit of IDR62.7 trillion (US$4.3bn) in Q1 2021, compared to a net loss of IDR460 billion (US$0.03bn) during the same period in 2020.

Ms Mekala concludes: “Indonesian life insurance industry is expected to face increased challenges in the short-term due to the impact of COVID-19 on the economy. Improving consumer confidence along with rising insurance awareness will aid the recovery of life insurance segment over the forecast-period.”