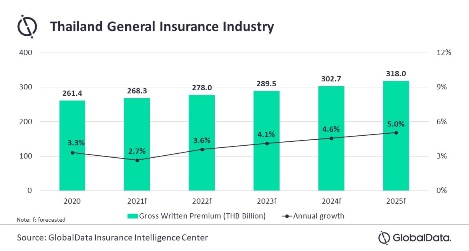

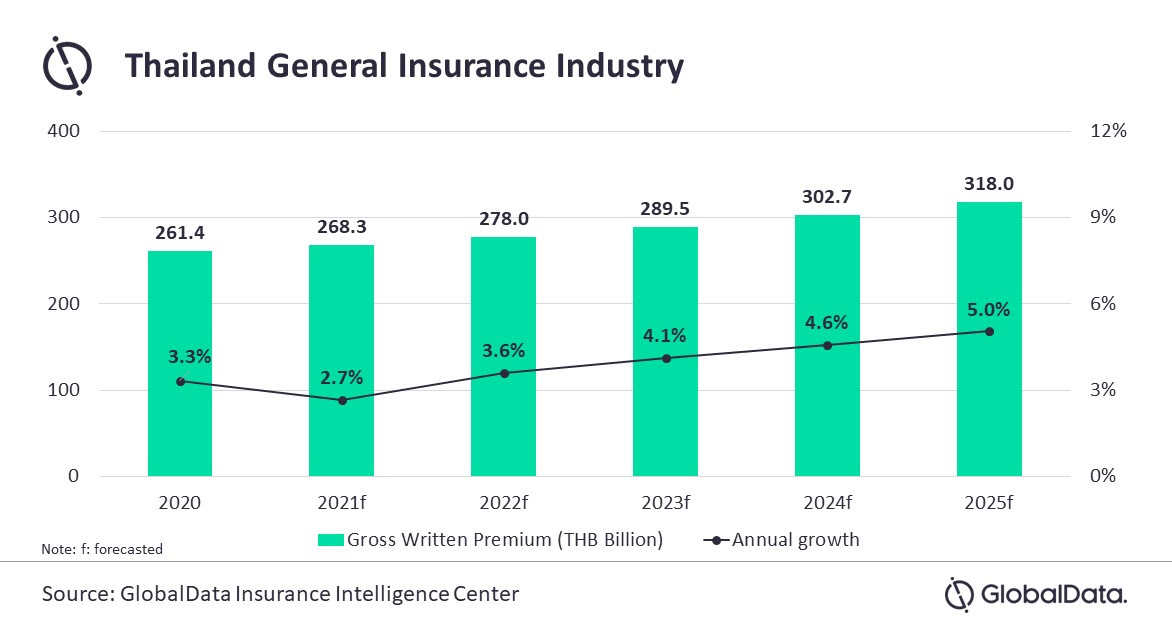

The general insurance industry in Thailand, in terms of gross written premiums, is projected to grow from THB261.4bn (US$8.4bn) in 2020 to THB318bn (US$10.6bn) in 2025, according to GlobalData, a leading data and analytics company.

GlobalData has revised Thailand’s general insurance forecast in the aftermath of COVID-19 outbreak. As per the latest data, the general insurance industry’s growth slowed to 3.3% in 2020 as compared to the 4.6% growth registered in 2019 due to the pandemic. Growth is expected to recover from 2022 onwards and witness upward trend, supported by the gradual economic recovery.

Pratyusha Mekala, Insurance Analyst at GlobalData, comments: “Thailand economy continues to suffer from the repercussions of the COVID-19 pandemic, which delayed the recovery of tourism sector. In addition, weak domestic activity is expected to impact the general insurance premiums in 2021.”

Motor insurance is the largest general insurance segment accounting for 56.3% of the general insurance GWP in 2020. Decline in automobile sales due to lockdown restrictions along with economic disruptions negatively impacted motor insurance growth, which declined from 5.6% in 2019 to 1.5% in 2020.

Motor insurance is witnessing signs of recovery due to gradual easing of lockdown restrictions, improved consumer demand and government stimulus measures. According to the Federation of Thai Industries, domestic car sales during January-April 2021 increased by 9.6% on year-on-year basis to reach 252,269 vehicles.

Personal accident and health insurance, which held 19.3% of general insurance premium in 2020, is expected to grow by 6.9% during 2020-2025. Health insurance, with 6.6% share in premiums, was the fastest growing segment registering 37.1% growth in 2020. Aging population, rising demand for COVID-19 health insurance policies, and increasing awareness supported health insurance growth.

Ms Mekala concludes: “The general insurance industry in the country is expected to face challenges in the short-term due to the resurgence of COVID-19 pandemic. Government’s stimulus packages and momentum in vaccine rollout will support the recovery of the general insurance industry.”