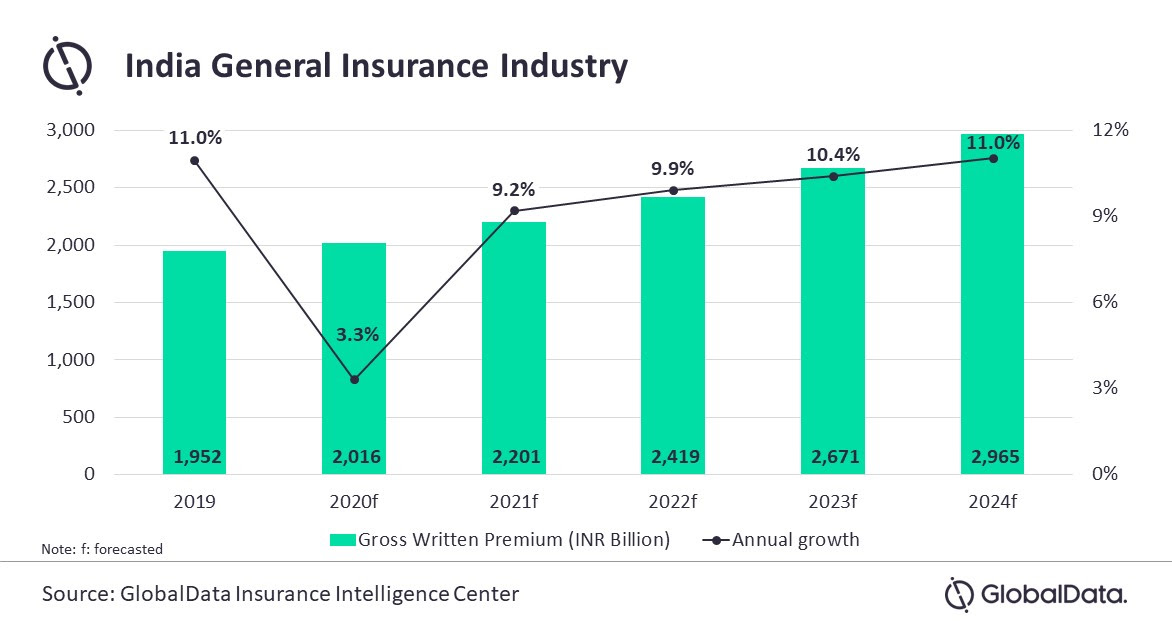

The general insurance industry in India is projected to grow from INR1.9 trillion (US$27.7bn) in 2019 to INR2.9 trillion (US$36.4 bn) in 2024, in terms of gross written premium (GWP), according to GlobalData, a leading data and analytics company.

GlobalData has revised India’s insurance forecast in the aftermath of the COVID-19 outbreak. As per the latest data, Indian general insurance industry is expected to grow at a compound annual growth rate (CAGR) of 8.7% over FY2019-2024, driven by economic recovery expected over the second half of 2021.

Deblina Mitra, Insurance Analyst at GlobalData, comments: “The Reserve Bank of India (RBI) has maintained the country’s GDP estimates at 10.5% for FY2022 despite the second wave of COVID-19 spread. Improvement in domestic demand and increased investment activity is expected to aid in the economic recovery.”

Motor insurance, which accounted for one-third of general insurance business in 2019, is expected to grow by 4.7% in 2021. The current decline in auto sales due to the re-imposition of lockdown at the federal level is expected to be short-lived. With pick-up in vaccination drive, economy is expected to recover over the second half of the year. This will restore demand for auto sales and motor insurance.

Property insurance, which accounted for 28% of general insurance business in 2019, is expected to grow by 10% in 2021, primarily driven by price increase. In 2020, fire insurance premiums were increased by up to 25% after GIC Re increased reinsurance rates.

According to GlobalData’s Global Insurance Database, personal accident and health (PA&H) insurance, which accounted for 29% of general insurance premium in 2019, is expected to remain strong and grow at a CAGR of 14.2% over the next five years.

Increased health awareness and demand for COVID-19 specific insurance products contributed to its strong retail sales last year. Additionally, the extension of ‘sale and renewal’ of COVID-19 specific health insurance products until September 2021 and the launch of standard personal accident insurance ‘Saral Suraksha Bima’ from 1 April 2021 are other positive developments that will further contribute to the demand for PA&H insurance.

Ms Mitra concludes: “The second wave of COVID-19 has dampened the recovery momentum in general insurance business. However, its impact is expected to be short-term as vaccine roll-out picks up pace in the second half of 2021. As a result, general insurance business is anticipated to recover strongly in 2021.”