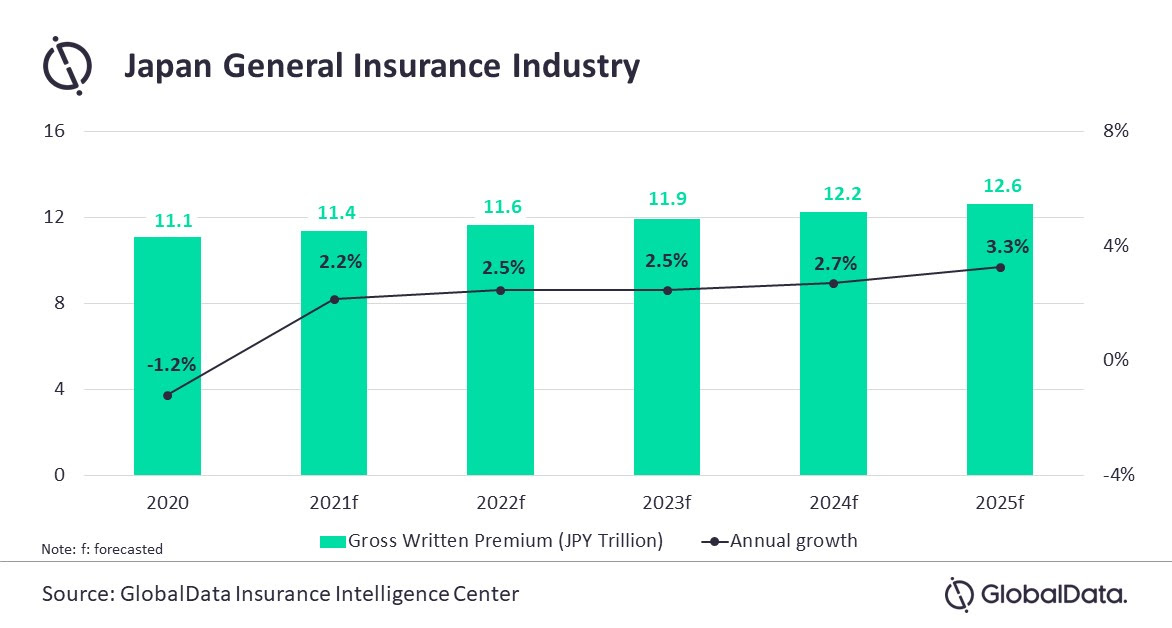

The general insurance industry in Japan is projected to grow from JPY11.1 trillion (US$104.1bn) in 2020 to JPY12.6 trillion (US$133.1bn) in 2025, in terms of gross written premiums (GWP), according to GlobalData, a leading data and analytics company.

GlobalData has revised Japan’s general insurance forecast in the aftermath of the COVID-19 pandemic. As per the latest data, the general insurance industry in Japan is expected to grow at a compound annual growth rate (CAGR) of 2.6% over 2020-2025, primarily due to recovery in economy after witnessing a decline in 2020.

Shabbir Ansari, Insurance Analyst at GlobalData, comments: “Japanese economy declined by 4.6% in the fiscal year ending March 2021 due to the recurrence of new COVID-19 variants and slow vaccine rollout. Restrictions imposed on manufacturing and construction activities translated into slower growth of general insurance lines of business in 2020.”

Motor insurance is the largest segment in the Japanese general insurance industry with 51.5% of GWP in 2020. It is forecasted to grow by 1.4% in 2021 against the decline of -3.6% in 2020, backed by improved vehicle sales. According to the Japan Auto Manufacture Association (JAMA), new vehicle registrations during January-April 2021 increased by 4.2% as compared to same period in 2020.

The segment is expected to grow at a CAGR of 1.7% during 2020-2025. The launch of fully autonomous vehicles targeting local and global markets as well as expansion of electric car market is expected to drive growth of the motor insurance segment during the forecast period.

Property insurance is the second largest segment, accounting for 25.1% of general insurance premium in 2020. The segment is expected to grow at a CAGR of 5.1% during 2020-2025. Frequent natural catastrophic events and increasing demand for real estate will support the growth of property insurance in the country. For instance, according to the General Insurance Association of Japan, 221,994 insurance claims were filed for damages caused by the Fukushima earthquake as of 12 May 2021.

Liability insurance segment accounted for 7.8% of the general insurance premiums in 2020. The segment is expected to grow at a CAGR of 2.8% during 2020-2025 driven by Third Party Liability sub-segment that accounted for 80% of the liability insurance premiums in 2020.

Mr Ansari concludes: “The Japanese economy is expected to face challenges in the short-term due to the impact of COVID-19 pandemic. Product innovation in the automobile sector and the country’s vulnerability to nat-cat events will drive the growth for general insurance industry during the forecast period.”