Enhancing Profitability

The finance ministry has directed state-owned general insurance companies to prioritize profitable ventures over merely chasing top-line growth. The government recently infused Rs 7,250 crore into three public sector insurers: National Insurance Company Limited, Oriental Insurance Company Limited, and United India Insurance Company.

Financial Improvement

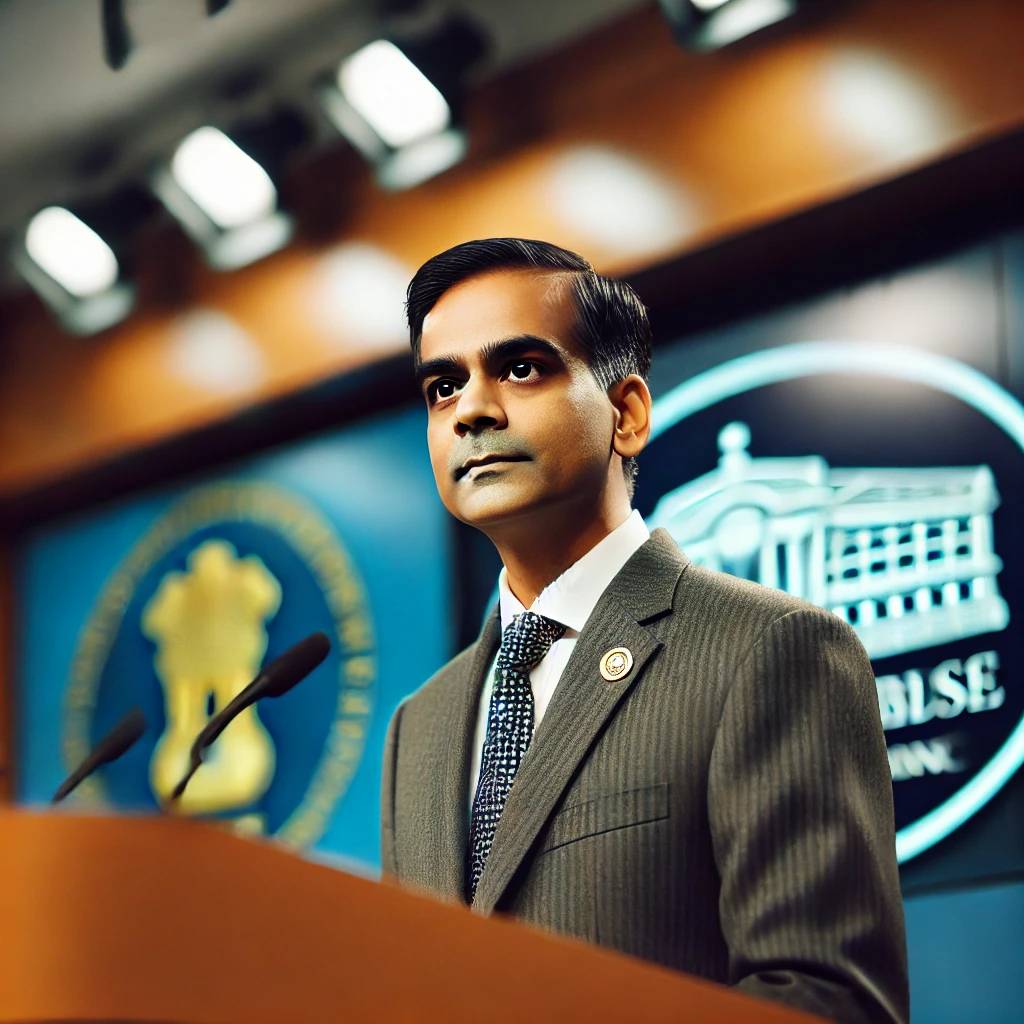

According to Financial Services Secretary Vivek Joshi, these companies are showing improved performance, potentially eliminating the need for further capital infusion. For instance, Oriental Insurance reported a profit of Rs 18 crore in FY24, reversing a Rs 5,000 crore loss from the previous year. National Insurance and United India Insurance also significantly narrowed their losses.

Operational Reforms

The ministry is addressing operational challenges, asking these companies to exit loss-making segments such as motor and health insurance. Since 2020-21, key performance indicators linked to reforms have been implemented to ensure efficient capital utilization and drive profitability.

Recruitment and Restructuring

The companies, previously under a hiring freeze, are now encouraged to recruit balanced workforces. This move aims to bolster their operational capacities and financial performance further.

Privatization and Market Listing

New India Assurance, the only listed state-owned general insurer, increased its profits from Rs 1,000 crore in FY23 to Rs 1,100 crore in FY24. The government has also announced plans to privatize one general insurance company, indicating a shift towards a more competitive market approach.

The finance ministry’s efforts aim to ensure sustainable growth and financial stability for these public sector insurers.