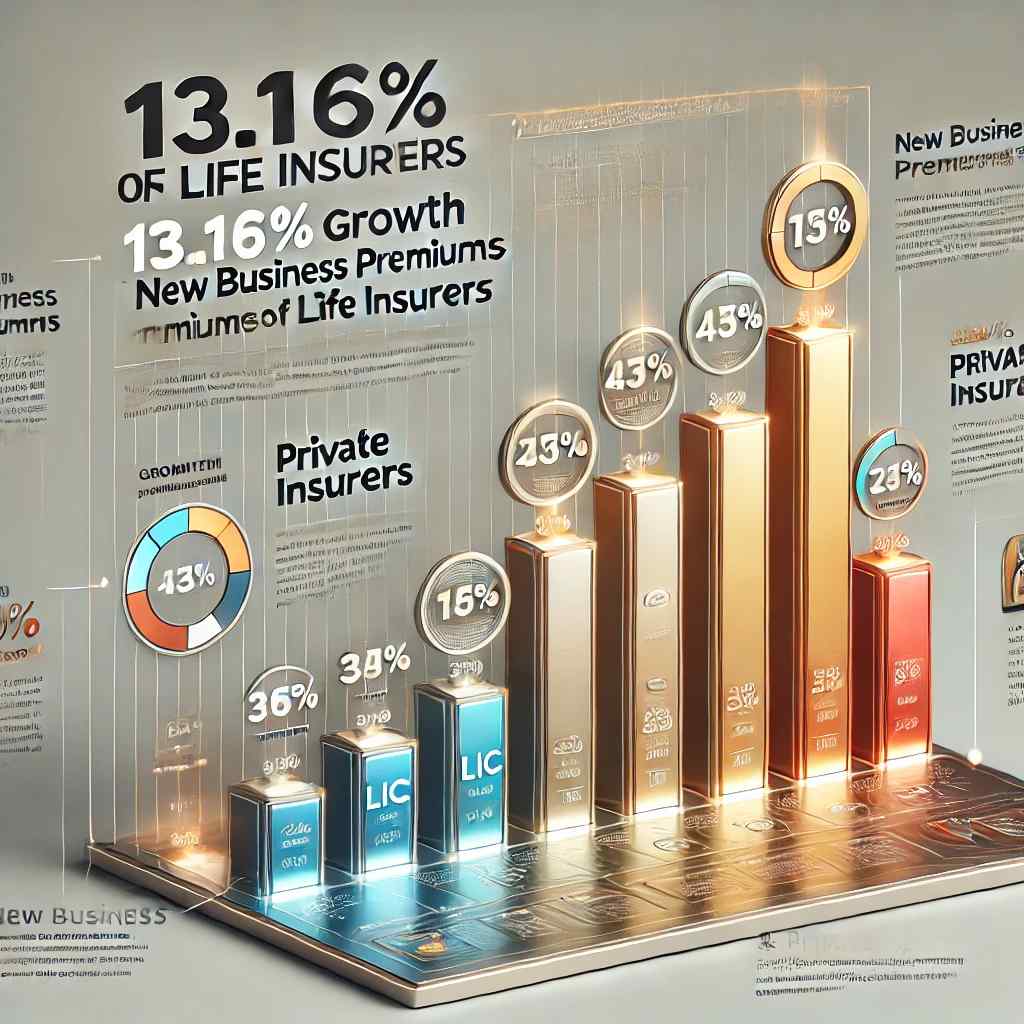

Life insurance companies in India reported a 13.16% year-on-year (Y-o-Y) growth in new business premium (NBP) for October 2024, collecting a total of Rs. 30,347 crore. This growth was largely driven by private sector insurers, despite a sharp decline in the number of policies sold.

Sector Performance: LIC vs. Private Insurers

According to data released by the Life Insurance Council:

- LIC (Life Insurance Corporation of India): The state-owned giant reported a 9.48% Y-o-Y increase in NBP, reaching Rs. 17,131 crore. However, the individual premium segment fell by 9.4% Y-o-Y to Rs. 3,712.62 crore, while group premiums surged by 15.5% Y-o-Y to Rs. 13,267.93 crore.

- Private Insurers: The private sector recorded an 18% Y-o-Y growth in NBP, totalling Rs. 13,216.51 crore. Among major players:

- HDFC Life Insurance: Achieved a 28% Y-o-Y growth, reaching Rs. 2,799 crore.

- ICICI Prudential Life: Reported a 25.29% Y-o-Y increase.

- Bajaj Allianz Life Insurance: Posted a 21.46% Y-o-Y growth.

- Max Life Insurance: Experienced a 15.3% Y-o-Y increase.

- SBI Life Insurance: Reported a slight decline of 3.8% Y-o-Y, totalling Rs. 2,648.38 crore.

Revised Surrender Value Norms Impact Sales

The decline in the number of policies sold during October, down by 46% compared to the previous year, was attributed to the implementation of new surrender value norms effective October 1, 2024. These norms require insurers to pay an enhanced special surrender value to policyholders after one year of premium payment. While the industry managed to implement these changes for about 80% of products, the adjustment period likely impacted new policy sales.

Industry Trends: April-October Period

During the April-October 2024 period:

- The life insurance industry’s NBP grew 18.56% Y-o-Y, totalling Rs. 2.19 trillion.

- LIC’s premiums increased by 22.5% Y-o-Y to Rs. 1.32 trillion.

- Private sector insurers saw a 12.9% Y-o-Y increase, totalling Rs. 86,880 crore.

- However, the number of policies sold declined by 5.42% Y-o-Y to 14.5 million.

Analyst Insights and Future Outlook

According to a Nuvama report, the revised surrender value norms impacted the October 2024 growth but kept it stable. Analysts believe that growth in term insurance and unit-linked insurance plans supported the industry’s performance despite challenges. “In the coming months, growth may fluctuate as the industry finds its balance,” the report noted.