State Consumer Commission Orders United India Insurance Co Ltd to Compensate Policyholder

In a significant judgment that underscores the importance of adhering strictly to policy terms, the State Consumer Commission has directed United India Insurance Co Ltd (UIICL) to pay Rs 4.4 lakh in compensation to a policyholder after rejecting his claim on questionable grounds. The case centers around a vehicle accident that occurred during a journey from Rudraprayag to Dehradun, in which the insurance company initially denied the claim by alleging a breach of policy terms due to the presence of a so-called “gratuitous passenger.”

Incident Overview

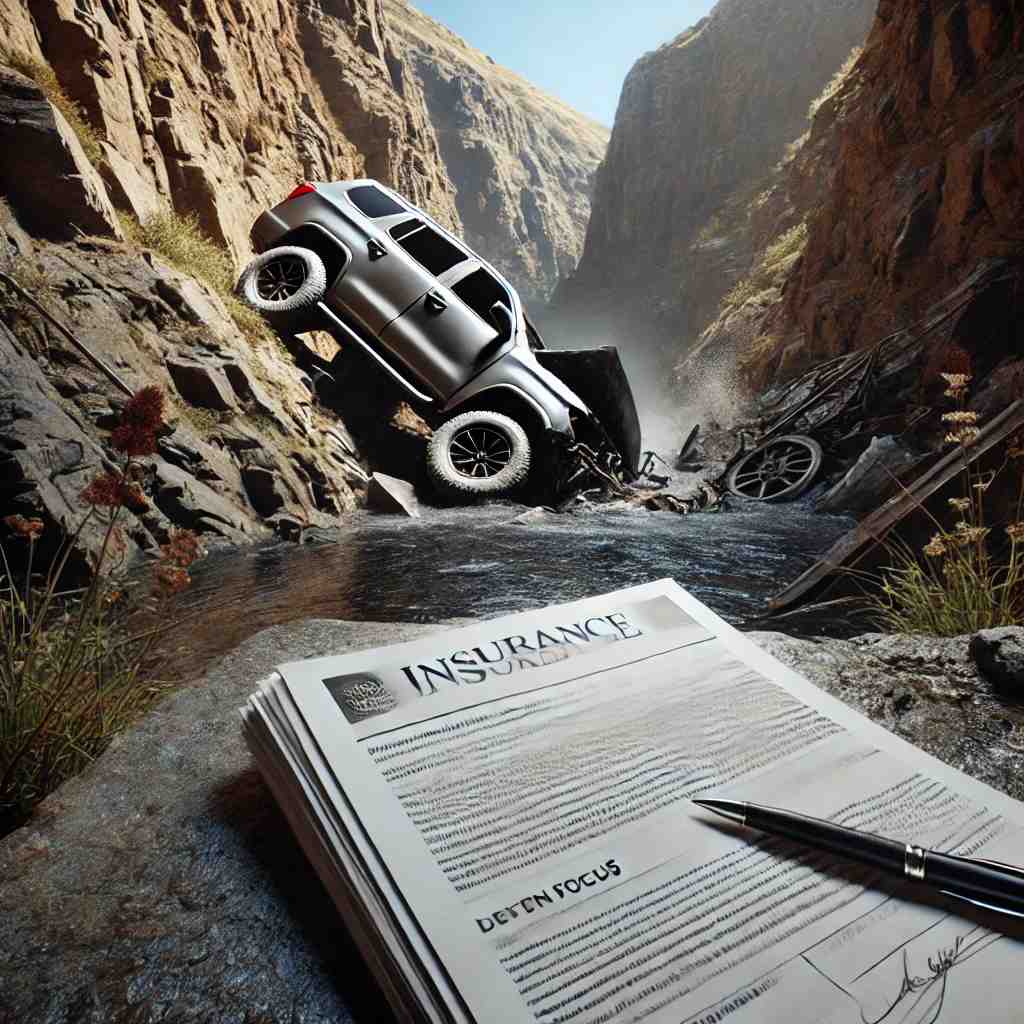

The policyholder, Trilok Singh, a resident of Dehradun, had his commercial vehicle insured with UIICL in December 2015. On June 7, 2016, the vehicle was involved in a tragic accident. The driver, Bhupendra Singh, lost control of the vehicle near Ratangarh, causing it to veer off the road and plunge into a deep gorge. The crash resulted in severe injuries to the driver and the complete destruction of the vehicle. Tragically, a passenger named Kanchan, who was in the vehicle at the time, lost her life due to the accident.

Claim Rejection by the Insurance Company

Following the accident, Trilok Singh filed a claim with UIICL for the damages incurred. However, the insurance company rejected the claim, asserting that the presence of Kanchan, whom they described as a “gratuitous passenger,” violated the terms and conditions of the insurance policy. UIICL argued that the policyholder was not entitled to compensation because the insurance did not cover passengers traveling without an explicit purpose related to the insured business or operation of the vehicle.

Legal Battle and District Commission’s Ruling

Unwilling to accept this denial, Trilok Singh took the matter to the district consumer commission. After reviewing the case, the district commission ruled in favor of Singh in October 2022, ordering UIICL to compensate him for the damages. The commission found that the insurance company had wrongly interpreted the policy terms and that the claim rejection was unjustified.

State Consumer Commission’s Verdict

UIICL challenged the district commission’s decision, taking the case to the State Consumer Commission. After a meticulous examination of the case documents and the arguments presented by both parties, the state commission upheld the district commission’s judgment. The commission noted that the vehicle had a seating capacity of three, including the driver, which was fully compliant with the insurance policy’s guidelines. Therefore, the presence of Kanchan did not constitute a breach of the policy’s terms.

The State Consumer Commission further adjusted the interest rate on the unpaid compensation, reducing it from 9% to 6%, but affirmed the need for UIICL to fulfill its obligation under the policy.

Final Order and Implications

The commission ordered UIICL to pay Rs 4.4 lakh in compensation to Trilok Singh, along with Rs 5,000 to cover litigation expenses. This ruling highlights the necessity for insurance companies to base their claim decisions on accurate interpretations of policy terms, ensuring that policyholders receive the coverage they are entitled to without facing arbitrary or unjust rejections.

This case serves as a reminder to both insurance providers and policyholders about the importance of understanding and following policy guidelines. It also emphasizes the role of consumer protection bodies in safeguarding the rights of individuals against corporate misconduct.