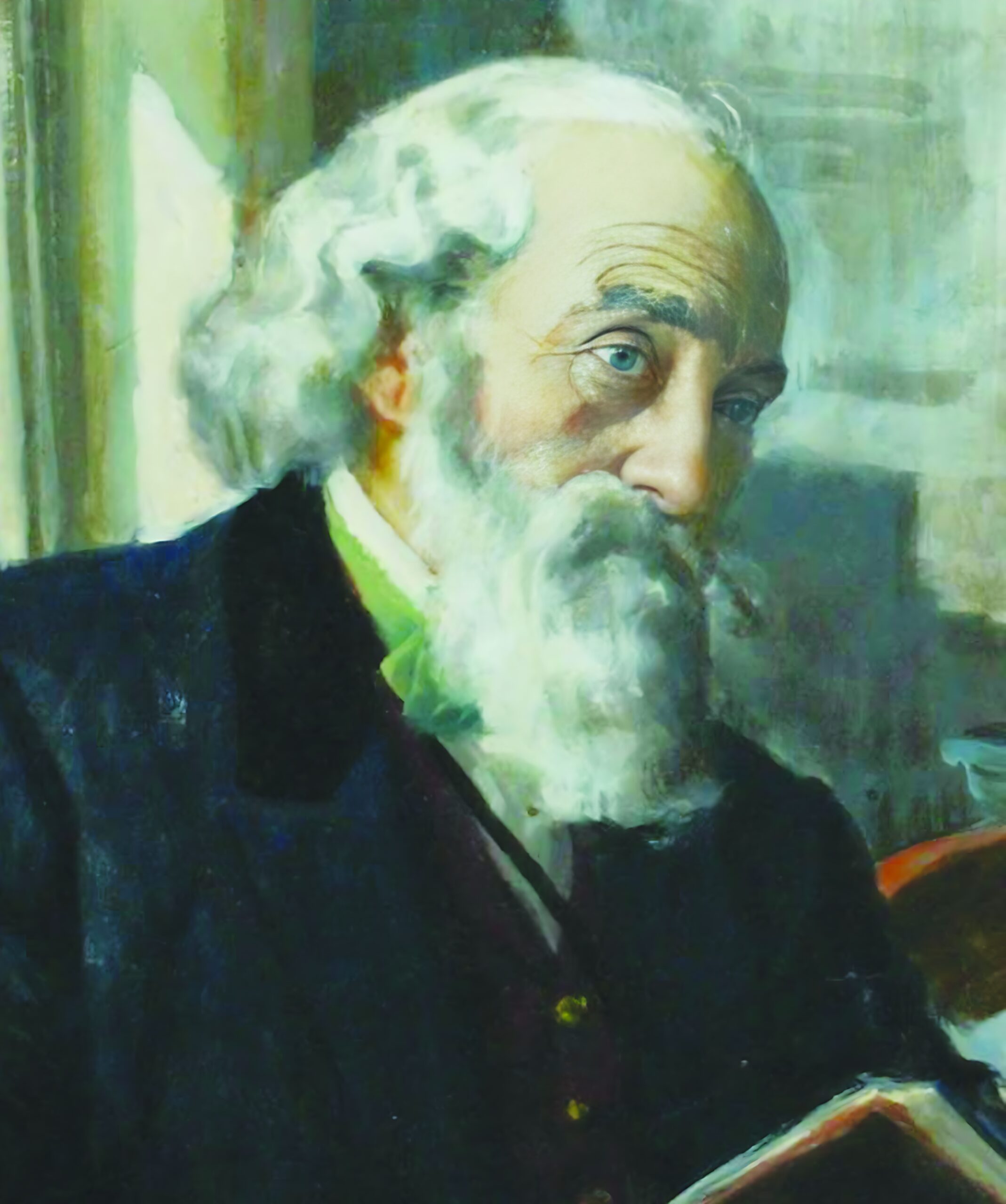

Elizur Wright, a 19th century American who started his career as a mathematician is widely considered to be the father of life insurance.

In 1844, there was a public auction of old, sick men in London. These men could no longer afford the premiums on their life insurance policies. Speculators would inspect the men and bid on the right to take over their premiums, become the beneficiary, and collect the proceeds when they died. Bidding was more active on those men who looked very ill. Elizur Wright hated this systembecause he believed:

- It is immoral to have a beneficiary invest in someone’s death.

- That the men who had been paying premiums, had nothing to show for cash value.

Wright was then in London to assess the calculations behind British life insurance practices to help an American life insurance company. Many life companies often failed to accurately estimate longevity and interest rates, leading to their insolvency. Of the 300 British life insurance companies formed up to 1830, 250 companies failed.Hence, Wright resolved to do the following:

- To fix the calculations, he published the first practical actuarial reference table for the US insurance industry in 1853.

- To force insurance companies to follow the calculations, he lobbied the state legislators in Massachusetts to regulate insurance companies. The new law compelled insurance companies to reveal their financial standing and reserves.

- The new law also benefitted the policyholders. It gave the policyholders more rights in terms of getting back at least some of the money they paid to life insurance companies. After becoming insurance commissioner, he introduced the concept of surrender &paid-up value – non-forfeiture provision.

The insurers soon found that the non-forfeiture provision was actually a selling point for its life insurance policies and brought in more business. The zeal of Wright for making sure life insurance companies continually prove their financial solvency made the Massachusetts-based life insurance companies attractive to potential customers nationwide.

In effect, operating under the regulatory rule of Elizur Wright was a seal of approval for a life insurance company in terms of its product, financial standing, and management. It helped Wright’s goal of making better life insurance products for consumers.

Thus, a mutually beneficial relationship grew between the regulator, the insurance companies and the policyholders. In today’s political climate, amidst the various debates about financial inequities and regulation, the “father of life insurance” is worth remembering.